A Guide for CPAs: Helping Clients Understand the Distinctions Between Defined Benefit (DB) and Defined Contribution (DC) Plans

Rohit Punyani, Co-Founder • December 28, 2023

A Guide for CPAs: Helping Clients Understand the Distinctions Between Defined Benefit (DB) and Defined Contribution (DC) Plans

Getting to Know Defined Benefit (DB) and Defined Contribution (DC) Retirement Plans

As a CPA advising small business owners and 1099 clients, your role in guiding them toward the right retirement strategy is critical. Understanding the core features of defined benefit and defined contribution plans can help your clients align their tax strategies and retirement goals.

What is a Defined Benefit Plan?

Defined benefit plans provide a specific, predetermined benefit at retirement. The most familiar example is a traditional pension.

These plans appeal to clients seeking stability and predictability. Many still value the fixed payouts and security associated with these structures. While less common today in corporate America, they remain a powerful tool for small businesses and solo entrepreneurs.

For clients with high incomes or looking for accelerated retirement savings, a 412(e)(3) plan—one type of defined benefit plan—is worth considering.

What is a Defined Contribution Plan?

Defined contribution plans depend on the amount contributed and investment performance. A well-known example is the 401(k). In these plans, participants choose how much to contribute and where to invest it.

For small business clients or independent contractors, defined contribution plans can be custom-built—often much larger than traditional 401(k)s—and may even incorporate some characteristics of a defined benefit structure. One such example is the cash balance plan.

Are DB & DC Plans the Only Options? | Hybrid Plans

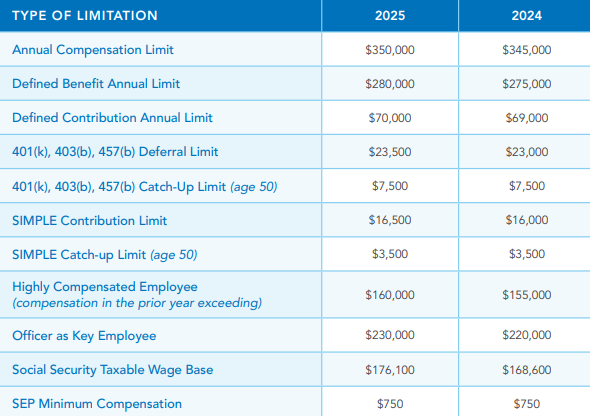

Many of your clients may want the advantages of both types: the high contribution limits and tax deductions of a DB plan with the flexibility of a DC plan like a 401(k).

Hybrid options, such as Cash Balance and 412(e)(3) plans, offer this blend—but require deeper planning. As their trusted advisor, your understanding of these nuances is crucial.

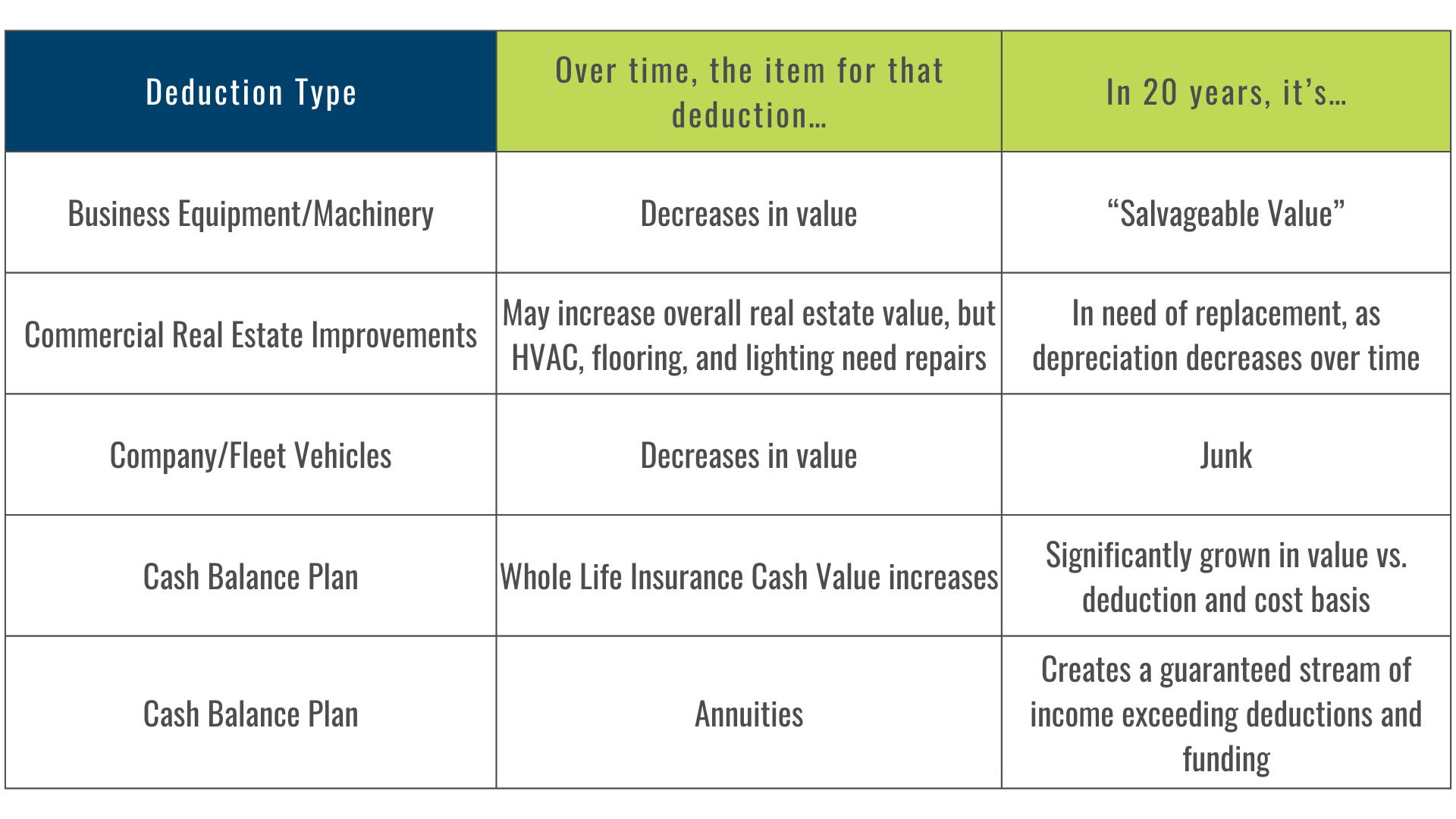

- Cash Balance Plans: These “hybrids” can invest in both marketable securities and more conservative assets like insurance.

- 412(e)(3) Plans: Fully insured, funded only through annuities and life insurance, offering very high contribution limits due to the absence of investment risk.

Life Insurance in DB Plans: A Strategic Tax and Estate Tool

Many CPAs are surprised to learn that life insurance inside a DB plan can be uniquely withdrawn without triggering taxes. Once removed, it continues to grow tax-free, remains creditor-protected, and can provide tax-free income and estate planning advantages—making it a versatile part of long-term financial strategy for clients.

Why CPAs Should Consider Recommending a Cash Balance Plan

Cash Balance Plans are often a better fit for small business clients because of their combination of flexibility and high contribution limits. However, these plans require third-party administration and careful design.

At Fusion Strategies, we specialize in custom-building these plans for business owners and professional service providers. We help CPAs and advisors implement them in a compliant and strategic way.

Key Features of a Cash Balance Plan

Cash Balance Plans allow investments in stocks, bonds, mutual funds, and even insurance. Contributions are age- and income-based—making them ideal for older, high-earning clients who want to catch up on retirement savings while still providing meaningful benefits to employees.

CPA Insight: Recommend this plan to clients needing larger deductions, looking to retain staff, or who prefer flexible investment vehicles.

Cash Balance Plan Benefits for Clients

- High Tax Deductions: Much higher contribution limits than 401(k)s.

- Asset vs. Liability: Unlike vehicles or supplies, these contributions build retirement assets.

- Recruitment Tool: Helps clients attract and retain top employees in competitive fields.

Implementation Guidelines CPAs Should Know

When advising clients on implementation:

- Annual Funding Required: Multi-year commitment (typically 3–5 years) is ideal.

- Employee Eligibility: Anyone working 500+ hours per year is typically covered.

- Works for Any Business Structure: Whether your client is an S Corp, C Corp, partnership, LLC, or sole proprietor.

Termination: What Happens When the Plan Ends?

Like a 401(k), Cash Balance Plans terminate by rolling participant balances into IRAs. This preserves the tax-deferred status of the funds.

Key Differences in 412(e)(3) Plans (Defined Benefit)

When to Recommend a 412(e)(3) Plan:

Suited for Small Companies

- 412 Plan (Defined Benefit): is suited for very small companies, sole proprietorships, or single-person structures.

Investment Constraints

- 412 Plan (Defined Benefit): Constrained to invest solely in insurance and annuities due to being a defined benefit plan, avoiding any risk associated with marketable securities.

Contribution Dynamics

- 412 Plan (Defined Benefit): Contribution amounts are higher due to fully insured products with a slightly lower rate of return, prioritizing lower risk.

Key Client Questions to Explore:

When discussing 412(e)(3) plans, help clients consider:

- Can they contribute consistently for 3+ years?

- Are they trying to attract or retain top-tier talent?

- Are they looking for high tax deductions and retirement contributions?

- Are they open to insurance-based planning strategies?

Final Thoughts for CPAs

Helping clients navigate DB, DC, and hybrid retirement plans is a powerful value-add to your advisory services. By recommending the right plan—whether a Cash Balance or a 412(e)(3)—you can help them reduce taxes, build wealth, and retain talent.

Fusion Strategies partners with CPAs to design, implement, and administer these plans. If your clients need guidance, we’re here to support your advisory team every step of the way.

Contact Us: https://www.fusion-strategies.com/contact