Helping Clients Rethink Conservative Investments in an Uncertain Bond Market

Shep Buckman, Co-Founder • December 7, 2023

A Strategic Opportunity for CPAs Advising Business Owners and 1099 Earners

You’ve likely encountered clients—particularly business owners and independent contractors—who are growing increasingly uneasy about the bond market’s volatility. These clients often turn to you for guidance on where to allocate their “conservative” investments now that traditional fixed-income instruments no longer offer the same reliability.

After a historically poor year for bonds in 2022 and only modest stabilization in 2023, many of your clients may be wondering if bonds are still a safe place to park their cash. For example, the iShares US Core Bond ETF (AGG), often seen as a benchmark, showed a 4.90% return in November 2023—an impressive rebound. However, this followed a dramatic 6.03% drop just two months earlier in September, underscoring the asset class’s growing unpredictability.

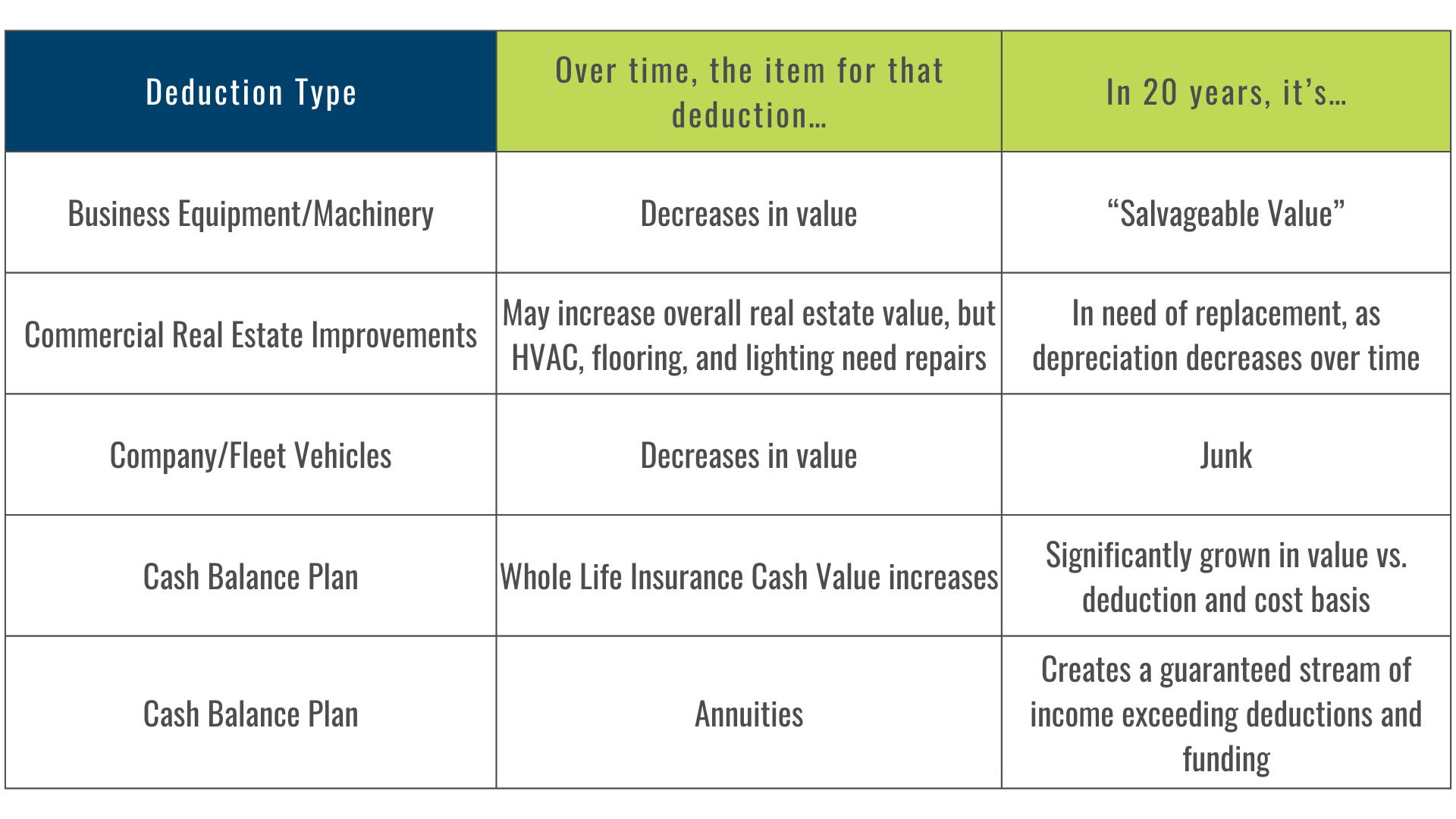

As a trusted advisor, you’re tasked with finding tax-efficient, stable alternatives that still meet your clients’ goals for capital preservation and reliable income. One such strategy—often overlooked—is the use ofwhole life insurance issued by mutual insurance companies.

Why CPAs Should Consider Whole Life Insurance for Conservative Clients

Whole life insurance is rarely positioned as a bond alternative, but in today’s market, it can be a compelling choice—especially when sourced through amutual insurer rather than a publicly traded one. Mutual insurance companies distribute dividends to policyholders, effectively returning a share of profits.

These dividends, when combined with guaranteed interest accrual on the cash value, create a dependable, tax-advantaged income stream.

Key features for your client to consider:

- Guaranteed Principal: Unlike bonds, whole life insurance cash values cannot decline, regardless of market conditions.

- Predictable, Competitive Yields: Interest is credited annually and is contractually guaranteed—this is not market-dependent.

- Tax-Free Income: Properly structured withdrawals (via policy loans or distributions) are entirely tax-free under current tax law.

- Dividend Participation: As partial owners in a mutual company, policyholders receive dividends, which can be used to further grow cash value or reduce premiums.

Addressing Your Client’s Goals: Stability, Liquidity, and Tax Efficiency

Many business owners are unaware that a properly structured whole life policy can function as a conservative core holding, offering stability and cash flow in retirement. When planned in coordination with their broader financial picture—including retirement, succession, and tax strategies—these policies can help insulate them from market turbulence while also providing tax-free retirement income.

As a CPA, you are in a unique position to identify which clients might benefit most:

- Those sitting on excess cash reserves looking for a safer alternative to bonds or CDs.

- High-income 1099 earners or S-Corp owners seeking long-term tax shelters.

- Clients interested in retirement income planning without taking on additional investment risk.

Let’s Collaborate to Serve Your Clients Better

At Fusion Strategies, we work directly with CPAs to structure whole life insurance solutions that align with both the client’s risk profile and long-term tax planning objectives. Our approach is not “one-size-fits-all.” Instead, we tailor each strategy to complement the CPA’s existing plan, not compete with it.

If you’re advising clients who are dissatisfied with the current fixed-income landscape—or simply seeking new avenues for stability and tax-free income—we invite you to connect with us.

Let’s explore how this overlooked tool can enhance your client’s financial strategy while reinforcing your role as their most trusted advisor. Contact Us: https://www.fusion-strategies.com/contact