Estate Planning

As a CPA advising small business owners and 1099 clients, your role in guiding them toward the right retirement strategy is critical. Understanding the core features of defined benefit and defined contribution plans can help your clients align their tax strategies and retirement goals.

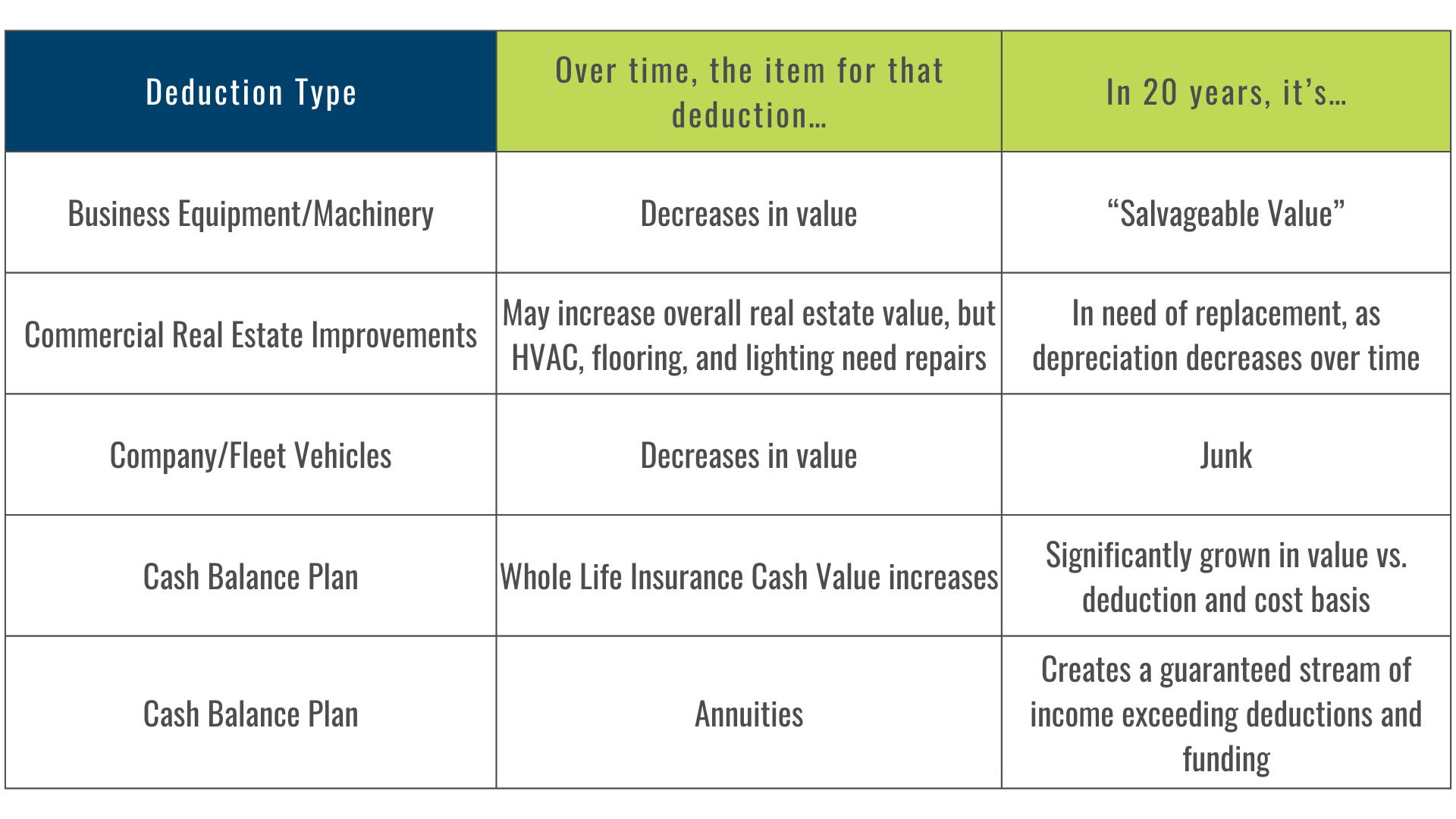

As a CPA, one of the most impactful strategies you can guide your small business and 1099 clients through is leveraging retirement planning for tax optimization. Defined benefit (DB) plans—whether traditional pensions, cash balance plans, or 412(e)(3) plans—represent a pre-tax deduction that can significantly reduce a client’s taxable income.

CATEGORIES

Legacy Plans

Estate Planning