What CPAs Should Know About the Taxation of Defined Benefit Plans

Rohit Punyani, Co-Founder • December 12, 2023

What CPAs Should Know About the Taxation of Defined Benefit Plans

A Guide for Advising Small Business and 1099 Clients

How Are Defined Benefit Plans Taxed?

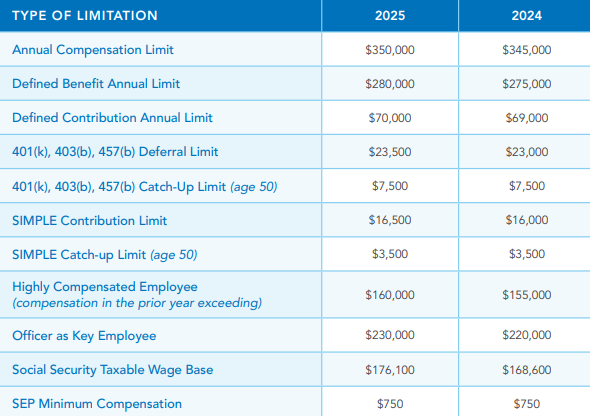

As a CPA, one of the most impactful strategies you can guide your small business and 1099 clients through is leveraging retirement planning for tax optimization. Defined benefit (DB) plans—whether traditional pensions, cash balance plans, or 412(e)(3) plans—represent a pre-tax deduction that can significantly reduce a client’s taxable income.

Reference: If you need a refresher on DB vs. DC plans, check out our blog: A Guide for CPAs: Helping Clients Understand the Distinctions Between Defined Benefit (DB) and Defined Contribution (DC) Plans

A Hypothetical Example

Consider a client structured as an LLC taxed as a partnership. If each partner receives a $200,000 K-1 distribution after expenses, that amount is fully taxable.

However, if you introduce a cash balance or 412(e)(3) plan, those same funds can be redirected into the plan. This results in a current-year deduction and a substantial tax reduction—often $0.40 on the dollar. This benefit recurs annually with each contribution.

Can Clients Access Their Money Later?

You or your clients may ask: “What’s the catch—can I get my money back out?”

Yes. Upon termination of the DB plan, participants roll their balances into IRAs. At that point, standard IRA rules apply:

- Distributions available after age 59½

- Taxed as ordinary income

- Required minimum distributions (RMDs) begin at age 72

Keep in mind that distributions may be further impacted by Social Security, Medicare, state income taxes, Medicaid, and provisional income calculations.

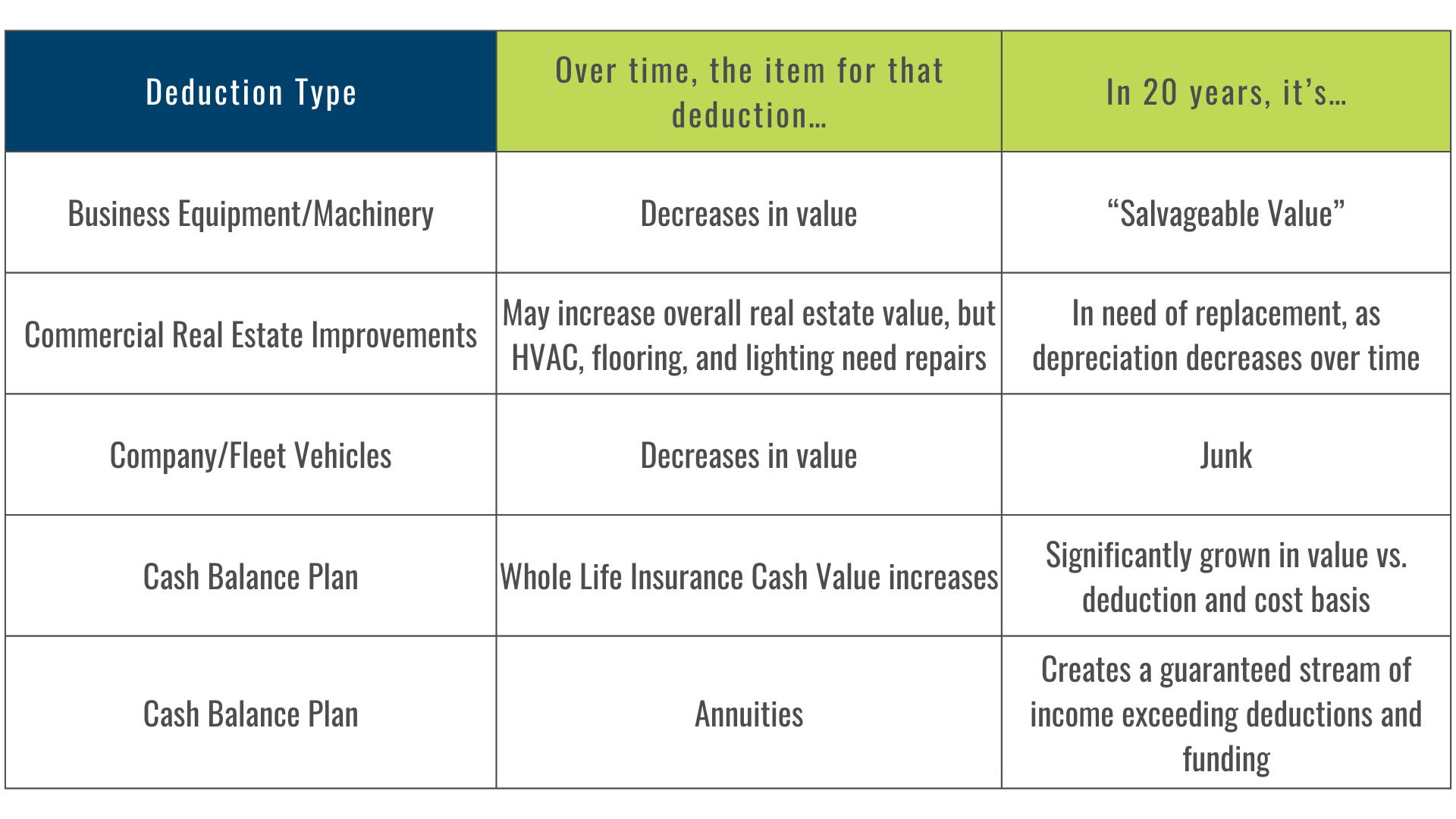

Using Life Insurance Strategically in DB Plans

For more sophisticated clients, you may want to explore incorporating life insurance into a DB plan. Because of its stable performance and unique tax treatment, life insurance offers a compelling retirement and estate planning tool.

- Key CPA Insight: Life insurance is the only asset in a DB plan that can be distributed in-kind without triggering taxes.

- Once outside the plan, it grows tax-free and can provide liquidity, tax-free income, and estate planning benefits.

Fusion Strategies frequently partners with CPAs to design and administer these strategies in both cash balance and 412(e)(3) formats.

What’s the Process for Small Business Clients?

Helping your client implement a defined benefit plan involves a structured, strategic process:

- Collaborative Planning

Work with Fusion Strategies to create an employee census and develop a plan that fits your client’s business objectives.

2. Employee Qualification

Employees with 1+ year of service and 500+ hours annually must be included. This impacts the contribution formulas.

3. Entity Setup

Like a 401(k), a separate legal entity is created to administer the plan. This ensures compliance and control.

4. Third-Party Administration (TPA)

A TPA handles regulatory filings like Form 5500 and plan compliance.

5. Leveraging Contributions

Each dollar contributed is also deductible, helping clients build assets while reducing tax liability.

What Does a Two-Person Plan Look Like?

For clients with only one employee (e.g. owner + assistant), a two-person DB plan can be both flexible and tax-efficient:

- The owner typically receives the lion’s share of the deduction.

- Contributions to the employee can be designed to be equal or greater—depending on age, salary, and goals.

Hypothetical Illustration

Let’s take a 60-year-old business owner and a 35-year-old employee, each earning ~$300,000 annually. With a combination of cash balance and 412(e)(3) plans:

The employee might receive:

~$86,000 in a cash balance plan

~$140,000 in a 412(e)(3) plan

The owner might receive:

~$300,000 in a cash balance plan

~$400,000 in a 412(e)(3) plan

Note: These numbers far exceed 401(k) contribution limits and can be adjusted to fit cash flow and funding preferences.

Conclusion: Your Role as a CPA

Your ability to recommend and structure defined benefit plans—especially for high-earning or late-start clients—is a powerful way to provide value. From tax minimization to estate and succession planning, DB plans offer flexibility and financial leverage.

Fusion Strategies specializes in partnering with CPAs to implement and manage these plans. Whether your client is evaluating a two-person plan, leveraging life insurance, or needing flexible contribution strategies, we’re here to support the process.

Ready to help your client explore a defined benefit plan? Contact Fusion Strategies to start a collaborative discussion.