What CPAs, Business Owners, and 1099 Earners Need to Know About Cash Balance Plans

Rohit Punyani, Co-Founder • June 2, 2025

In any conversation regarding retirement plans for business owners and CPAs, one of the questions we inevitably come across is “What is a cash balance plan?” Generally, they can be understood as a modified version of an old-school pension plan, and the Department of Labor offers a convenient overview here. However, we feel there’s more value in going beyond the definitions to understand these plans based on how they benefit business owners.

Consider that as a CPA or business owner, you are faced with balancing multiple objectives: keeping more of what you earn, meeting the needs of the client, and planning for the long term as it relates to your personal and business goals. Savvy CPA’s have come to utilize the cash balance plan to do just that.

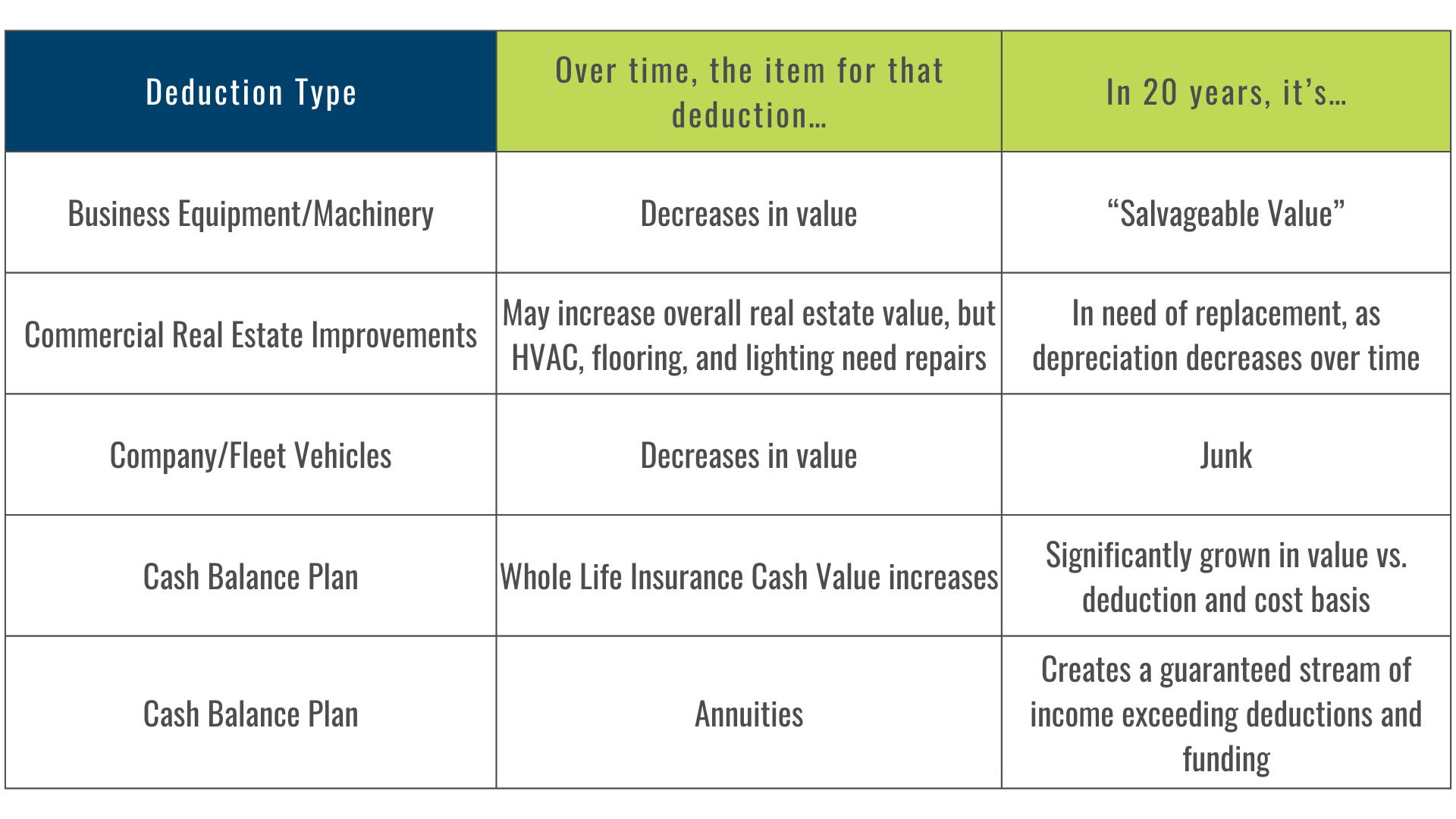

When we talk about retirement plans for business owners, there’s truly no better asset for you and your business, including your estate, taxes, business succession, and retirement planning. In fact, we think of cash balance plans as the Swiss Army Knife of retirement planning since they are so valuable for maximizing deductions! Remember, this is a deduction to acquire an asset, not a deduction to buy a liability; wealth creators, savvy CPA’s, and sophisticated owners use these plans to create wealth and reduce taxes.

Cash Balance Plans: The Personalized Pension Strategy

Cash balance plans can generally fall into two categories: defined benefit plans and defined contribution plans. Essentially, they create an opportunity for a business owner or independent contractor to build their own customized pension (which is why we’ll use the term pension and cash balance plan interchangeably). This is advantageous for multiple reasons because business owners and independent contractors can contribute significantly larger amounts of money to a cash balance plan than they can to a 401(k) while receiving a substantially larger tax deduction for doing so.

As we like to say, a cash balance plan is a way to turn a corporate expense into a personal asset. If you think about it this way, the value proposition is absolute. It offers a deduction today, an asset tomorrow, and a demonstrably more secure retirement with the added benefit of lower taxes forever.

The power of a cash balance plan lies in the significant flexibility associated with the design. A 401(k) typically only allows plan holders to choose between stocks and bonds from a preset menu. With a cash balance plan or private pension, you may acquire alternative assets that offer tax benefits. For example, in addition to stocks and bonds, you can design a plan to include annuities and dividend-paying whole life insurance. This type of plan creates the opportunity for guaranteed payments, zero sequence of returns risk, and incredible benefits for both estate planning and managing your retirement income–all tax-free!

A Note for CPAs: Contribution Limits and Tax Benefits [2025]

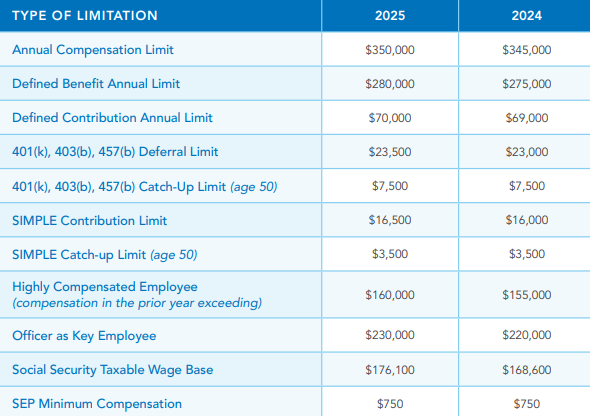

As mentioned previously, cash balance plans offer much larger contribution limits than 401(k) plans. Why? Both the IRS and the Department of Labor recognize two key differentiators for business owners and independent contractors when compared to traditional pre-retirees and taxpayers: firstly, that you have taken a risk by opening a business or becoming self-employed. Secondly, that you may not have access to traditional retirement plans for a period of time. In order to level the playing field and reward small business owners and independent contractors, the limits for private pensions or cash balance plans are significantly larger than those of a traditional 401(k). These contribution limits come with correspondingly higher tax deductions.

Below is a simple table comparing and contrasting the 2024 and 2025 retirement plan limits for the major retirement structures that exist (bookmark this for yourself and the business owners for whom you offer tax advice).

As you can see, the two types of cash balance plans–defined benefit plans and defined contribution plans–allow for substantially higher contributions than 401(k)s. For more information on current contribution limits, please see SSA Notice 2024-80.

Filing Tips and Thoughts: Where does it go?

For CPAs advising business owners using a cash balance plan, filing can be intricate. While each case is specific to the type of entity, number of owners, and the design of the plan, there are a few common threads when reporting a plan to the IRS:

- The CPA will put the contribution amount on line 16 of Schedule 1

- For an S-corp, use the W-2 to size the plan

- For a 1099 or Sole Prop, use the net line 31 of Schedule C

- For a C-corp, use W-2 income to size the plan

- Generally, the TPA will generate the Form 5500

How Cash Balance Plans Work?

Many people are familiar with how 401(k) plans work, but how do cash balance plans compare?

- Like a 401(k), contributions to a cash balance plan are pre-tax deductions. Contributing to a cash balance plan is a top-line deduction for a business.

- Unlike a 401(k), which has a 2025 contribution limit of $23,500, the contribution limits for a cash balance plan can be as high as $280,000 or more, depending on age, income, and structure.

- With a cash balance plan, the amount you can contribute and deduct goes up as your age and income increase. Conversely, a 401(k) restricts high-income earners to the same contribution limits as someone who is just beginning their career.

- Cash balance plans offer greater latitude when curating the investment and asset options, while 401(k) plans restrict investment options.

It’s important to note that cash balance plans have a mandatory 3-year minimum commitment, after which all benefits under the plan must be fully vested. That commitment is approximately level each year. Conversely, you do not have to contribute to a 401(k) each year, and you do not have to contribute the same amount each year. Due to this aspect, cash balance plans are effective and advisable only for companies with stable cash flows and excess profits sufficient to meet the mandatory three-year minimum, coupled with the level 3-year commitment. This is perhaps the most important consideration when committing to a cash balance plan.

Another key consideration is the IRS-mandated rate of return on cash balance plans. In order for business owners and self-employed individuals to make the most of the large contribution limits and deductions of cash balance plans, the IRS enforces stipulations to ensure that an abnormally high rate of return, AKA excess risk, cannot be taken in your pension. This is true of every pension, whether it is from a Fortune 100 company pension or a small business.

Many other factors impact how cash balance plans work, depending on the unique nature of the plan designed exclusively for your business or 1099 income. In general, however, the asset and investment flexibility coupled with significantly larger deductions make cash balance plans more attractive than standalone 401(k)s. Interestingly enough, you can contribute to both a 401(k) and a cash balance plan.

Combining a Cash Balance Plan with a 401(k)

A 401(k) can be combined with a cash balance plan and is, in fact, advisable. This is typically called a combo plan, and it allows for a unique asset allocation across the two plans. Because of the lower contribution limits in a 401(k), it is advisable to take more risk in terms of stocks versus bonds, etc., in the 401(k). Given the IRS-mandated lower rate of return in a cash balance plan, it is both savvy and sophisticated to use risk-free and lower-risk strategies in the cash balance plan.

Plan Termination and Risks

There are risks associated with a cash balance plan, just like funding a pension plan. Terminating the plan before the stated minimum IRS guidance is not advisable. Like a pension, the plan should be properly funded (not underfunded) each year. As such, it represents a liability to the organization and may affect the taxability and tax structure of the plan.

Administrative Considerations

As with a 401(k), a third-party administrator (TPA) is needed to properly build and audit cash balance and combo plans each year. This is a protection put in place for both the business and its employees. A good TPA values audits and administers the plan each year, in addition to generating Form 5500.

The cost of such a plan varies according to the asset mix, the level of service of the TPA, the number of participants in the plan, and the size of the plan. It is important to know, however, that TPA fees are generally considered deductible and should be discussed with your CPA–or, for CPAs facilitating cash balance plans, with the client. The fees associated with the plan are deductible, so this should not deter one from looking at a potential six-figure cost for the business.

Taking the Next Steps

Cash balance plans represent one of the most interesting and strategic opportunities for small business owners and independent contractors to fund their retirement while offering succession, estate, cash flow, and tax planning benefits. It takes a seasoned and experienced team of advisors, strategists, accountants, and TPAs to properly design and build the cash balance plan that is right for your specific needs and goals.

At Fusion Strategies, this is precisely where we excel. We exist to serve CPAs, small business owners in other fields, and independent contractors by helping them identify niche strategies to manage their taxes and build the retirement plan of their dreams. When you’re ready to generate more possibilities for your future, we’re here to help you lay the groundwork. Reach out to us today.