When Is the Best Time for Clients to Buy Cash Value Life Insurance?

Rohit Punyani, Co-Founder • September 24, 2024

A Strategic Perspective for CPAs Advising High-Income Clients

As a CPA, you’re often guiding clients through financial decisions that affect not just their taxes, but their balance sheets, long-term planning, and legacy. One increasingly relevant topic in this context iscash value life insurance, particularly dividend-paying mutualwhole life insurance, used in advanced strategies such aslegacy banking, estate planning, and tax diversification.

A question we frequently hear—often from clients in stable or high-income financial positions—is:

“When is the right time to buy cash value life insurance?”

While there’s no one-size-fits-all answer, this guide outlines the timing considerations CPAs should understand when evaluating permanent life insurance for clients.

Why Timing Matters

The earlier a client starts a properly structured whole life policy, the more favorable the results—particularly in terms of:

- Cash value accumulation

- Policy flexibility

- Lifetime dividend potential

- Compounding over multiple decades

Much like investing or funding retirement accounts, whole life policies benefit fromtime in the policy, not timing the market. The growth iscontractual, tax-deferred, and in the case of mutual insurers, supported bynon-guaranteed but historically consistent dividends.

Exception to the Rule: Major Near-Term Liabilities

If a client is facing a significant near-term financial obligation—such as a business acquisition, capital investment, or large personal expense—it may be prudent to first secure convertible term coverage.

This locks in age-based underwriting and insurability while preserving the option to convert into a whole life policy when cash flow improves.

In these situations, recommending convertible term coverage now—followed by a structured whole life policy within 12–18 months—is often the most prudent path.

Understanding the Asset Class: What CPAs Need to Know

A dividend-paying whole life policy offers the following characteristics, which make it unique in a planning context:

- Guaranteed death benefit and guaranteed cash value accumulation

- Tax deferred growth, with tax-free access via policy loans

- Dividends, often used to purchase additional paid-up insurance and enhance compounding

- No market volatility or correlation with equities

- Creditor protection in many jurisdictions

- Estate planning utility via Irrevocable Life Insurance Trusts (ILITs)

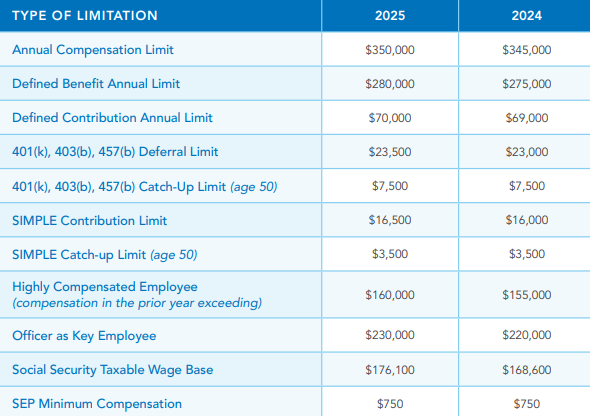

In addition, unlike 401(k)s or IRAs, there are no contribution limits (within MEC guidelines), offering flexibility for high earners who’ve maxed out traditional tax-advantaged vehicles.

Factors That Influence When to Buy

As a CPA evaluating client readiness, consider the following:

- Stable cash flow: Can the client fund a multi-year premium commitment without disrupting other obligations?

- Financial goals: Is the objective retirement income, estate liquidity, tax-advantaged savings, or intergenerational planning?

- Health and insurability: Younger and healthier applicants secure more favorable underwriting classes and premiums.

- Use case: Are there upcoming needs like college planning, business succession, or a desire for private banking-style liquidity?

A client with high tax exposure, predictable income, and long-term planning goals is often in a prime position to benefit from starting early.

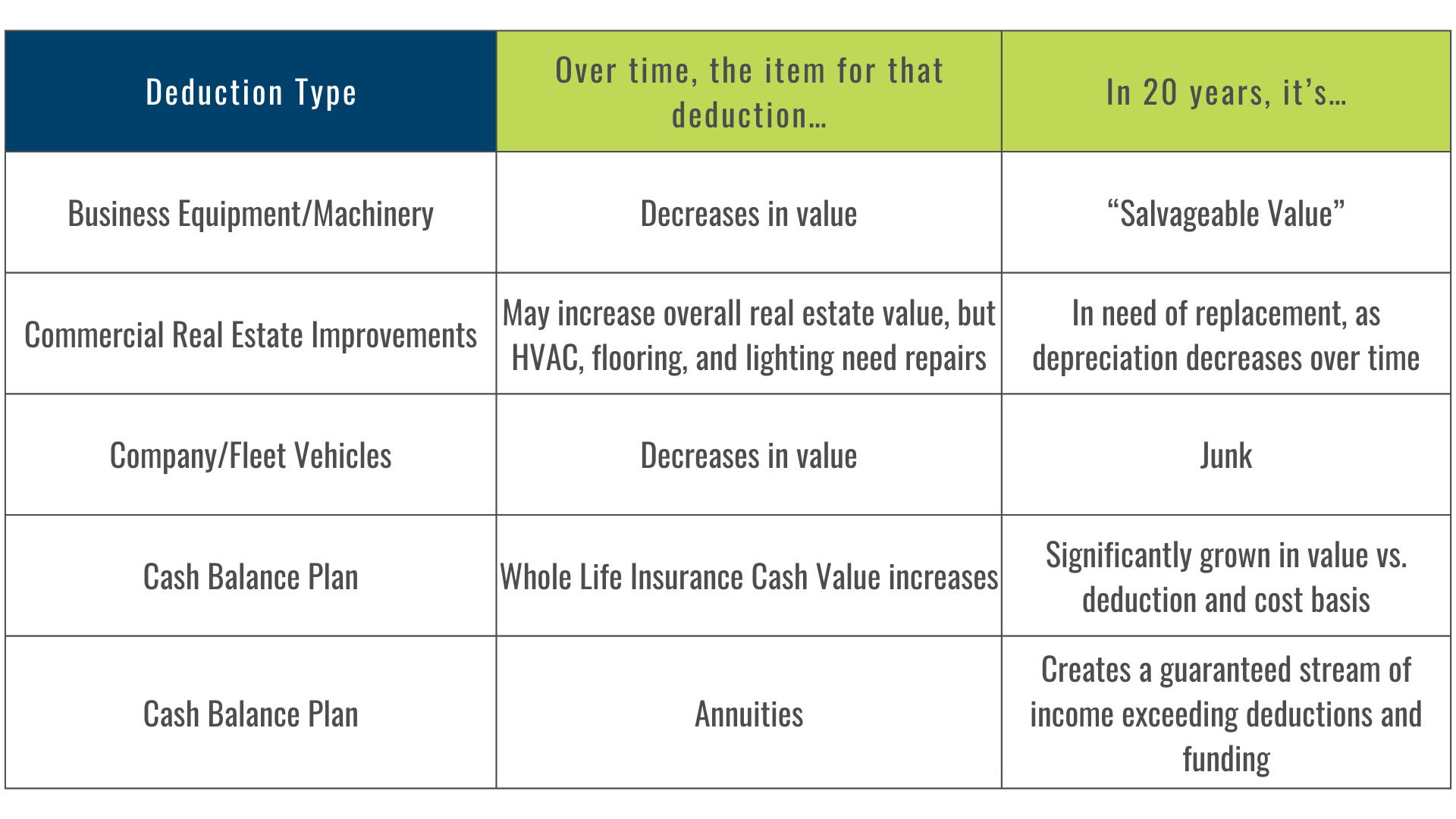

Design Matters: Matching Strategy to Structure

The timing of purchase is just one part of the equation. The structure of the policy—including the funding horizon, premium allocation, and use of Paid-Up Additions (PUAs)—determines how quickly cash value grows and how useful the policy becomes as a financial instrument.

Short-pay policies (funded over 7–15 years) accelerate early cash value and can be effective for clients nearing retirement or preparing for large upcoming expenses. Long-pay or blended designs maximize long-term compounding and typically deliver more total economic value over decades.

As a CPA, you can help clients model:

- Opportunity cost vs. liquidity access

- Tax implications of policy loans

- Cash flow modeling for debt service vs. policy contribution

- Estate inclusion and potential need for trust ownership

Avoiding Common Delays

One common mistake is clients waiting for a “better financial moment” to begin exploring permanent insurance. While cash flow should be reliable before a policy is funded, the ability to start small and scale up makes this strategy more accessible than many assume.

Even modest initial contributions can be structured to build over time, laying the foundation for:

- Policy-based college funding

- Tax-advantaged retirement income

- Debt optimization through policy loans

- Legacy and charitable giving strategies

For families with young children, policies can also be issued on minors as part of amulti-generational planning strategy. These are often highly efficient, given low premiums and long time horizons.

Final Thought: Align Policy Timing with Planning Objectives

If your client has ranked their financial priorities, understands their long-term goals, and is financially stable, then the right time to begin exploring cash value life insurance may be now. As with most compounding strategies, waiting usually reduces total value, and earlier implementation allows for greater tax efficiency and planning flexibility.

At Fusion Strategies, we partner with CPAs to tailor permanent life insurance solutions that support your client’s overall plan. From early accumulation strategies to late-stage estate structuring, we help ensure that each policy complements—not competes with—your advisory role.

Let’s Discuss Timing and Structure for Your Clients

Contact Us: https://www.fusion-strategies.com/contact

Visit:https://www.fusion-strategies.com/blog

The information provided is for educational purposes only and does not constitute legal, tax, or financial advice. Life insurance policies and tax laws can be complex, and their applicability depends on individual circumstances. It is recommended that you consult with a qualified financial advisor, tax professional, or legal expert to determine how these concepts apply to your specific situation. The content is based on current tax laws as of the publication date and may be subject to change. We are not responsible for any errors or omissions, nor for the results obtained from the use of this information.