How Long Does It Take to Build Cash Value with Whole Life Insurance?

Rohit Punyani, Co-Founder • October 9, 2024

A CPA’s Guide to Evaluating Cash Value Growth and Structuring Legacy Banking Strategies

As a CPA advising clients on wealth preservation, tax planning, and retirement strategy, you’ve likely been asked about the use of whole life insurance as a financial asset—especially in the context of“legacy banking,” where clients use a dividend-paying whole life policy to build tax-advantaged cash value and access it during their lifetime.

One of the most frequent questions from clients considering this approach is:

“How quickly does the cash value build?”

The short answer: immediately—but not all policies are structured equally, and there are meaningful trade-offs that influence cash value growth in the early years.

Understanding How Cash Value Builds

To understand how cash value accumulates, it’s useful to think of a whole life insurance policy like amortgage—but in reverse. Just as mortgage payments consist of principal (building equity) and interest (paid to the lender), whole life premiums include:

Abase premium, which funds the death benefit and contributes modestly to cash value

APaid-Up Additions (PUA) rider, which rapidly accelerates the policy’s cash value and dividend potential

For policies issued by mutual insurance companies, policyholders are essentially part-owners of the company. This ownership model makes the policy eligible to receive dividends, which can be used to purchase additional paid-up insurance and further increase cash value.

For clients who prioritize early liquidity—for example, to create a tax-advantaged source of capital for investments, business financing, or debt payoff—designing the policy with a larger PUA allocation is key to jump-starting growth.

Early Cash Value vs. Long-Term Growth: Trade-Offs to Consider

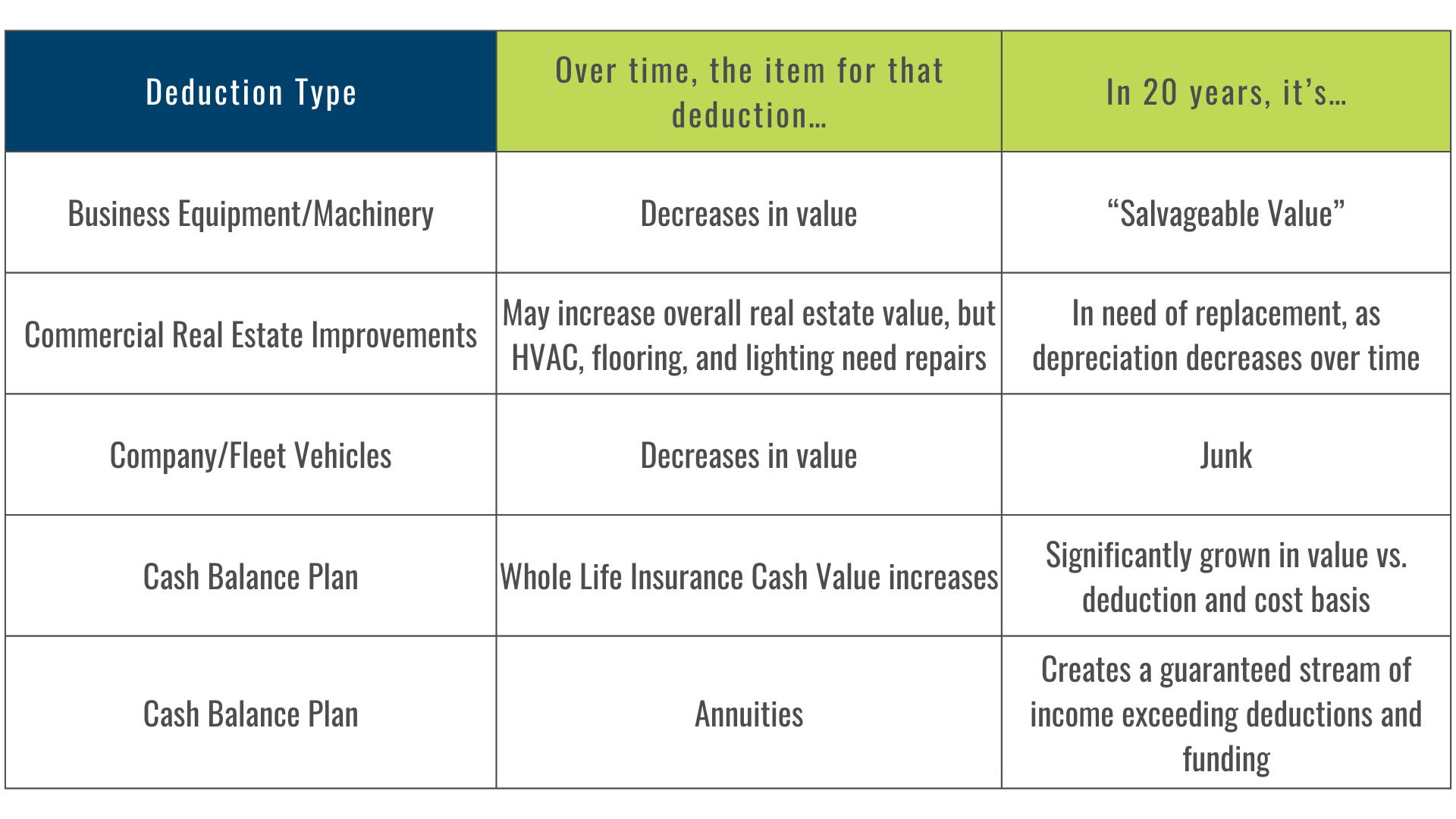

Policies structured to maximize early cash value—often referred to as “short-pay” policies—are front-loaded with premium over a limited period (typically 7 to 15 years). These designs create liquidity faster but can reduce:

- The long-term compounding effect of the policy

- The total volume of premium that can be contributed over time

- The cumulative economic value of the policy across decades

For clients interested in estate planning, retirement income, or intergenerational wealth transfer, it may be more advantageous to fund a policy over a longer duration. This extended funding allows for greater total contributions, which can generate a higher death benefit, stronger cash value performance, and a more impactful long-term tax shelter.

As a CPA, helping your client determine the appropriate funding schedule involves weighing:

- Liquidity needs vs. estate planning objectives

- Short-term vs. long-term use of the policy

- Total insurability and desired death benefit

- The role of the policy within a broader retirement or asset protection plan

When Short-Pay Policies Make Sense

Despite their limitations, short-pay policies can be effective in specific scenarios:

- College planning, where the client needs available cash value in 10–15 years

- Pre-retirement planning, particularly for clients in their 50s looking to create a tax-free income stream

- Estate liquidity strategies, where rapid cash value buildup is needed for ILITs or generational wealth transfer

That said, short-pay designs should be approached carefully. A policy designed solely for early accumulation may offer less value over time if the client’s objectives shift—or if their circumstances demand extended flexibility.

A Framework for Evaluation

We often encourage CPAs and their clients to assume that the policy being designed may be theonly permanent life insurance they will ever own. With that in mind, it’s important to evaluate:

- Cash flow availability and funding horizon

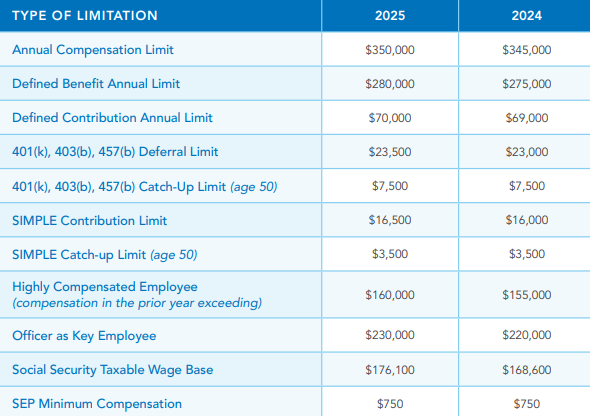

- Tax bracket exposure during working years and in retirement

- Legacy or estate goals, including whether an ILIT structure is appropriate

- The potential use of policy loans to finance personal or business needs without disrupting investment holdings or triggering taxes

When structured correctly, a whole life policy offers uninterrupted, tax-deferred compounding, tax-free liquidity through loans, and a death benefit that passes income tax-free to heirs or a trust.

Supporting Your Client’s Planning Process

Your clients may initially ask, “How soon will I have access to cash value?” But the more important question is:

“How does this strategy support my overall financial objectives over time?”

As a CPA, you play a critical role in helping clients model the impact of different policy designs and incorporate them into a broader financial framework—whether for liquidity, retirement income, buy-sell planning, or long-term tax mitigation.

At Fusion Strategies, we work directly with CPAs to structure policies that align with each client’s specific financial, estate, and tax goals. Our focus is on integrating insurance into a well-rounded strategy, not selling one-size-fits-all solutions.

Let’s Talk About Your Clients’ Options

Contact Us: https://www.fusion-strategies.com/contact

Visit:https://www.fusion-strategies.com/blog