Key Person Insurance: A Strategic Business Continuity Tool for Your Clients

Rohit Punyani, Co-Founder • May 21, 2024

How CPAs Can Help Safeguard Client Enterprises Against the Loss of Essential Personnel

As a CPA advising closely held businesses or professional service firms, you’ve likely helped clients navigate risk in many forms—from tax exposure to succession challenges. One often overlooked yet essential area of business risk planning is the loss of a critical team member whose expertise, leadership, or institutional knowledge is central to the company’s continued success.

Key person insurance is a planning strategy that can help your clients build long-term resilience into their operations while preserving continuity and enterprise value.

Defining the Key Person

A key person is anyone whose absence would materially disrupt the business. This often includes owners, founders, lead revenue producers, and key executives. It may also include professionals with licenses or certifications critical to the operation—such as attorneys, engineers, medical professionals, or credentialed financial officers.

Their value may be tied to technical knowledge, strategic leadership, client relationships, or their role in driving revenue. Helping clients identify these individuals is the first step in designing a meaningful key person insurance solution.

Tax Considerations and Policy Structure

Understanding the tax treatment of key person insurance is critical when guiding clients through implementation.

- Premiums are generally not tax-deductible, since the business is both the owner and beneficiary.

- Death benefits are typically received tax-free, provided the business complies with notice, consent, and filing requirements under IRC §101(j).

- Cash value policies offer liquidity and flexibility. Loans and withdrawals can be accessed for operating needs, investments, or compensation planning, without immediately triggering tax consequences.

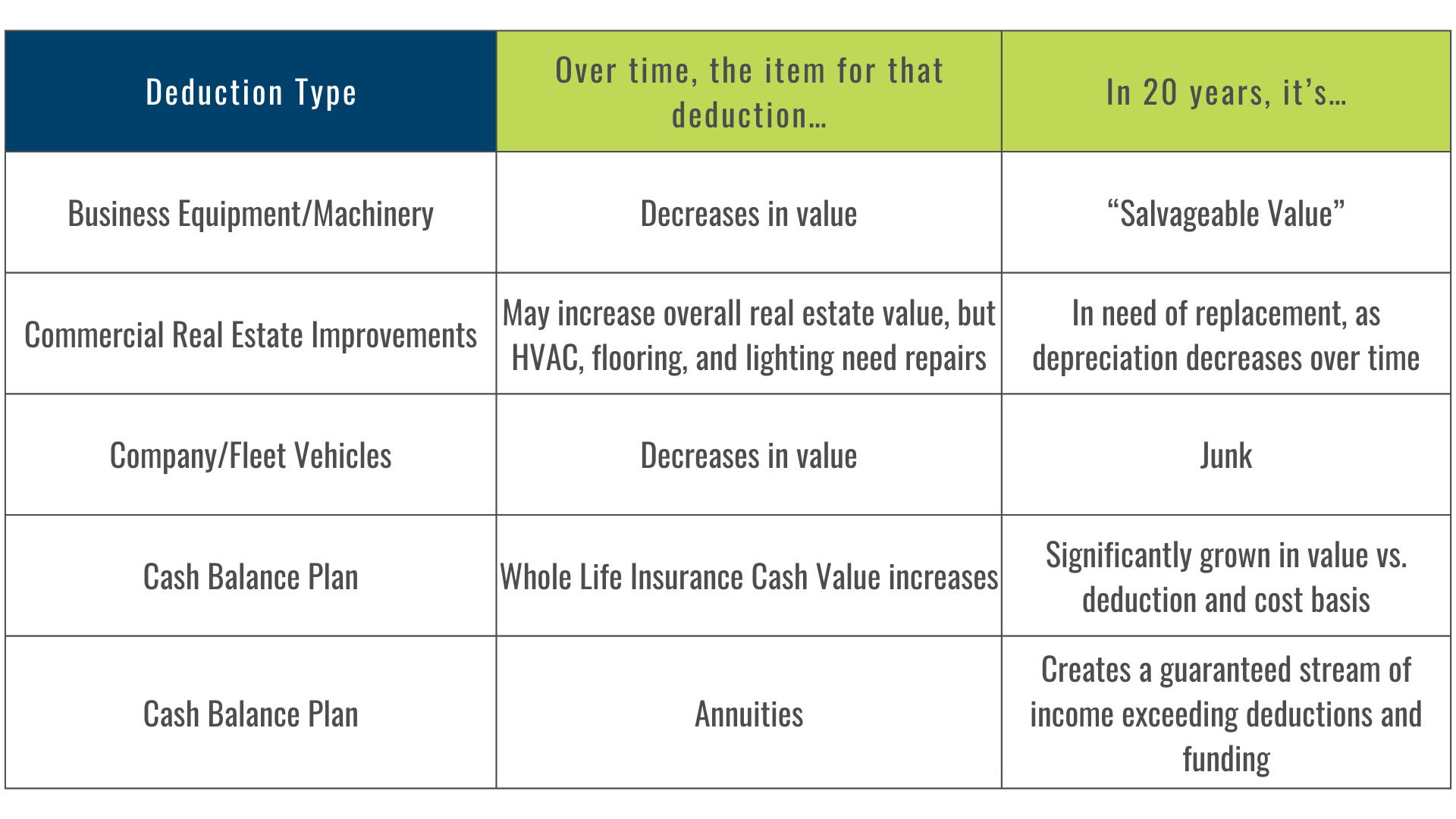

CPAs can add value by helping clients weigh term versus permanent coverage. While term policies are cost-effective for temporary needs, permanent policies provide lifetime coverage and accrue cash value, which can support broader financial or succession planning goals.

Assessing Coverage Needs

Determining the right amount of coverage goes beyond a basic salary multiple. CPAs should help clients consider:

- The cost of recruiting and training a replacement.

- Temporary losses in productivity or revenue during the transition period.

- The direct financial impact of the key person’s absence on business development or strategic planning.

- The potential need to fund bonuses or retention packages to stabilize remaining leadership.

Coverage amounts typically range from 3x to 10x the individual’s salary, but a thorough financial impact analysis will yield a more accurate and defensible figure.

Key Person Insurance as a Planning Asset

In addition to covering operational disruption, key person policies can serve a broader role in a client’s financial strategy:

- Executive compensation: Policies can be structured to provide supplemental retirement income or executive retention bonuses (such as via a SERP).

- Balance sheet strength: A funded key person policy enhances liquidity and improves perceived creditworthiness with lenders and investors.

- Succession planning: Policies can be used to fund buy-sell agreements, maintain stability during leadership changes, or transition equity in a controlled manner.

These applications allow CPAs to position insurance as a strategic asset that supports multiple planning objectives.

Compliance and Optimization

To ensure tax-free treatment of death benefits and maintain compliance:

- Notice and consent must be obtained before the policy is issued, per IRC §101(j).

- Form 8925 must be filed annually if applicable.

- Documentation should be retained to verify that all regulatory requirements are met.

CPAs should also evaluate opportunities to optimize coverage based on evolving needs. Strategies such as a policy transfer, change of insured rider, or eventual surrender can align the policy with retirement or exit planning while maintaining tax efficiency.

At Fusion Strategies, we often work with CPAs and their clients to enhance profitability using permanent key person policies as a tool to manage working capital. By leveraging tax-advantaged growth and the loan provisions of these contracts, businesses can significantly improve capital efficiency while still protecting against personnel risk.

Does Key Person Insurance Make Sense for Your Client?

If your client is dependent on one or two individuals for stability, growth, or technical expertise, the answer is almost certainly yes. Key person insurance doesn’t just fill a risk-management gap—it supports business value, succession continuity, and long-term planning flexibility.

To explore how a policy can fit into your client’s broader planning framework, our team is ready to collaborate with you.

Contact Fusion Strategies

Contact Us: https://www.fusion-strategies.com/contact

For more advanced planning insights, including the use of whole life insurance in business and estate strategy, visit:https://www.fusion-strategies.com/blog