Life Insurance as a Strategic Financial Planning Tool

Rohit Punyani, Co-Founder • June 11, 2024

How CPAs Can Guide Clients in Integrating Insurance into Their Wealth Strategy

A CPA is often the first point of contact when clients seek guidance on building long-term financial security. While traditional investment vehicles like stocks, bonds, and qualified plans dominate most portfolios, a growing number of high-income earners and business owners are looking for alternatives that offer both tax efficiency and financial stability.

Properly structured life insurance—particularly permanent insurance—can serve as a powerful asset class within a broader financial plan. Beyond providing a death benefit, life insurance can contribute to cash accumulation, retirement income planning, asset protection, and estate liquidity. Understanding how different policy structures work will allow you to advise clients on aligning these tools with their specific financial goals.

Term vs. Permanent Insurance

The distinction between term and permanent insurance is foundational:

- Term insurance provides temporary protection for a fixed period. It is typically used to cover short-term obligations (e.g., mortgage payoff or income replacement during working years). It does not build cash value and expires without benefit if the insured outlives the term.

- Permanent insurance, on the other hand, offers lifelong protection and the ability to accumulate

cash value. It acts not only as insurance but also as a financial instrument, allowing policyholders to access liquidity through policy loans or withdrawals. Permanent policies come in various forms, each with differing risk, flexibility, and tax implications.

Three Primary Types of Permanent Life Insurance

1. Variable Universal Life (VUL)

VUL policies combine life insurance protection with investment options, allowing clients to allocate premium dollars to subaccounts that function like mutual funds. These policies provide upside potential but also expose cash value to market risk. The death benefit and cash value fluctuate based on investment performance.

Considerations for CPAs:

- VUL may be suitable for clients with higher risk tolerance and investment knowledge.

- Investment performance impacts both policy sustainability and long-term cost of insurance.

- Policy management is critical to avoid lapses or unexpected premium increases.

2. Index Universal Life (IUL)

IUL policies credit interest based on the performance of a market index (e.g., S&P 500), subject to caps and floors. While clients are not directly invested in the market, they can benefit from index-linked gains with downside protection.

Considerations for CPAs:

- IUL offers more predictability than VUL, with lower risk exposure.

- Floor rates protect against market losses, while caps limit upside.

- Suitable for clients seeking moderate growth with some flexibility.

3. Whole Life Insurance

Whole life is the most conservative form of permanent life insurance. Issued by mutual companies, it provides guaranteed death benefits, fixed premiums, and contractual cash value growth. Dividends, when paid, enhance cash value and are not guaranteed but historically consistent.

Considerations for CPAs:

- Ideal for clients seeking stability, asset protection, and long-term cash accumulation.

- Particularly useful for estate liquidity, tax-free retirement distributions (via policy loans), or legacy planning.

- Cash value is not correlated to the market and offers contractual guarantees.

Structuring for Long-Term Success

Permanent policies must be structured correctly to provide the intended benefits. CPAs can support this process by helping clients:

- Determine appropriate face amounts based on needs (income replacement, estate planning, business succession, etc.)

- Understand how funding levels (e.g., overfunding within IRS guidelines) can impact long-term performance

- Evaluate tax implications of withdrawals and loans

- Select riders that address specific risks (e.g., chronic illness, disability waiver, paid-up additions)

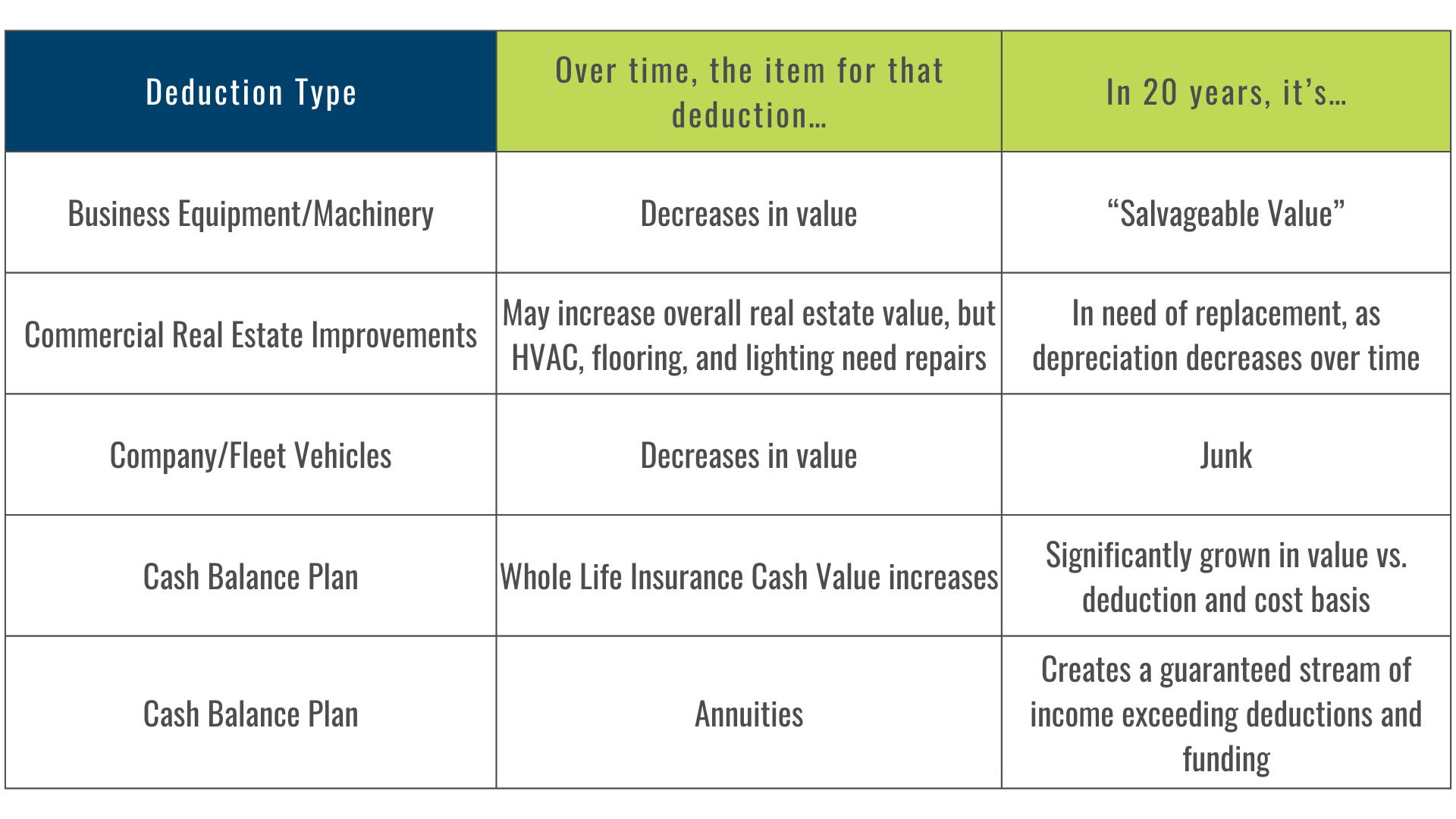

Life insurance can also serve as a strategic complement to tax planning—particularly for clients in high brackets or those with fully funded qualified retirement plans. When structured for accumulation, a properly funded policy may allow clients to access tax-free distributions in retirement, helping reduce reliance on taxable income sources.

Supporting Clients with Objective Guidance

Many clients are unaware that life insurance can function as a tax-advantaged asset class. As a CPA, your role in identifying appropriate uses—whether for asset diversification, estate liquidity, executive compensation, or business continuity—is critical.

At Fusion Strategies, we specialize in designing insurance-based financial solutions that integrate seamlessly with broader financial and tax plans. We work directly with CPAs to support planning strategies across wealth tiers, ensuring policies are structured for efficiency, compliance, and long-term value.

If you have clients evaluating permanent life insurance or exploring new approaches to long-term tax mitigation, we’re here to assist.

Contact Fusion Strategies

Email: team@fusion-strategies.com