Blog

Dividend-paying mutual whole life insurance is perhaps one of the most misunderstood and underutilized tools for business owners and 1099 earners, making it an invaluable addition to your CPA business offerings. So many think of this insurance simply as an expense today that could provide a death benefit tomorrow.

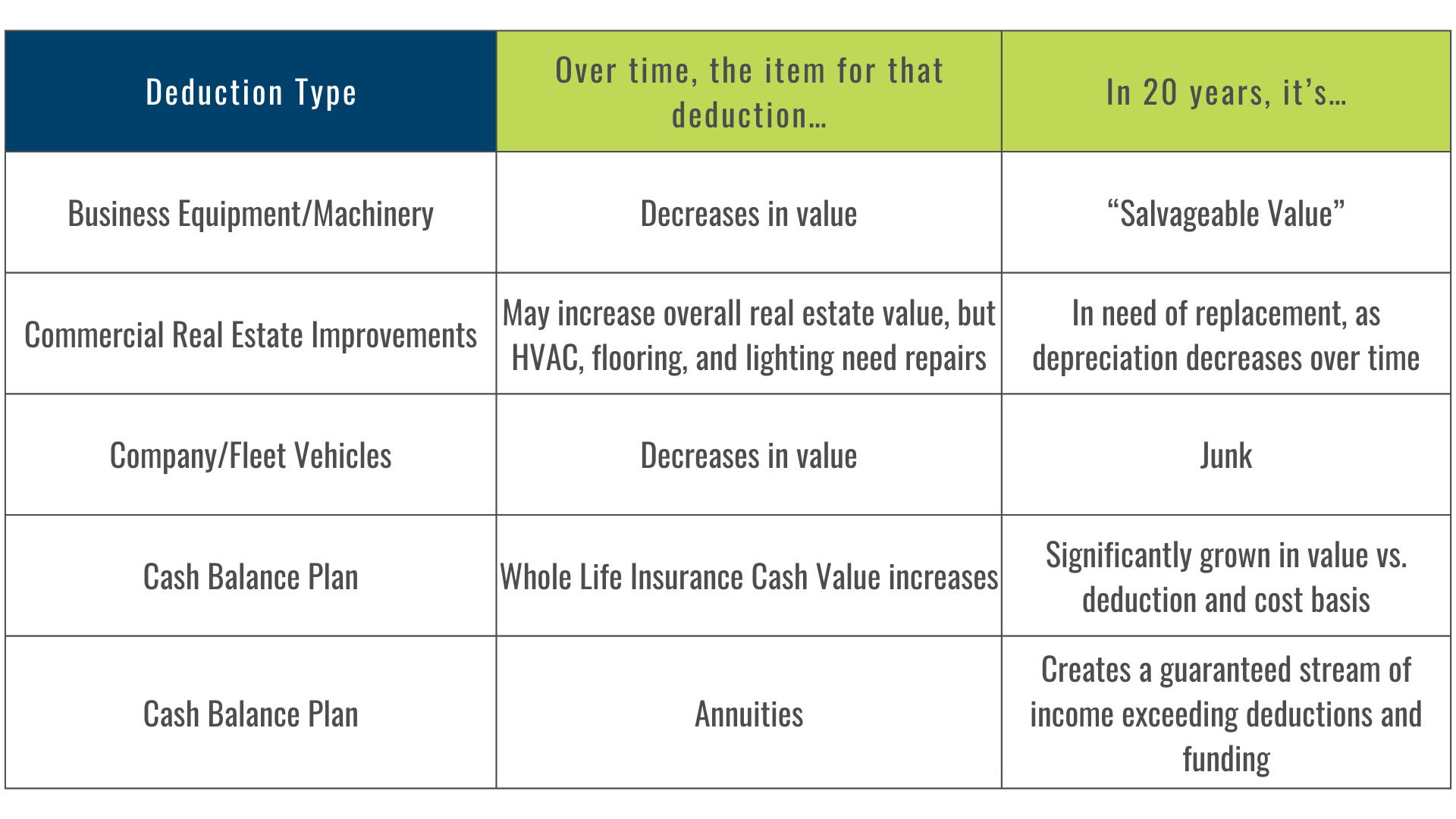

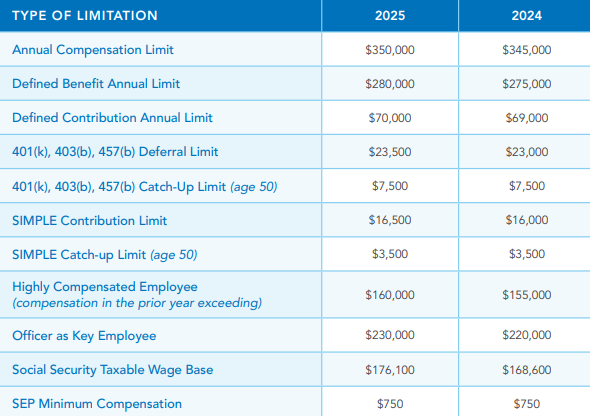

In any conversation regarding retirement plans for business owners and CPAs, one of the questions we inevitably come across is “What is a cash balance plan?” Generally, they can be understood as a modified version of an old-school pension plan, and the Department of Labor offers a convenient overview.

Tax accountants are often the first call when clients evaluate how to finance real estate investments—particularly those interested in leveraging tax-advantaged liquidity and minimizing opportunity costs. One lesser-known but increasingly relevant tool in this space is dividend-paying whole life insurance, specifically through policy loans against cash value.

As a CPA advising clients on wealth preservation, tax planning, and retirement strategy, you’ve likely been asked about the use of whole life insurance as a financial asset—especially in the context of “legacy banking,” where clients use a dividend-paying whole life policy to build tax-advantaged cash value and access it during their lifetime.

As a CPA, you’re often guiding clients through financial decisions that affect not just their taxes, but their balance sheets, long-term planning, and legacy. One increasingly relevant topic in this context is cash value life insurance, particularly dividend-paying mutual whole life insurance, used in advanced strategies such as legacy banking, estate planning, and tax diversification.

As a CPA, you’re often the first line of inquiry when clients ask about the tax implications of financial products, including life insurance. The answer to whether life insurance premiums are tax-deductible isn’t straightforward—it depends on entity type, ownership structure, and the policy’s purpose.

This guide is designed to help CPAs understand when and how life insurance interacts with the tax code and how it can be strategically leveraged for tax planning, liquidity, and wealth transfer.

For CPAs working with high-net-worth clients, managing debt, liquidity, and asset growth requires more than just conservative planning. Increasingly, clients are exploring more integrated strategies—especially those that combine asset growth with tax efficiency and flexible access to capital.

As a CPA, you’re often the first point of contact when clients seek guidance on building long-term financial security. While traditional investment vehicles like stocks, bonds, and qualified plans dominate most portfolios, a growing number of high-income earners and business owners are looking for alternatives that offer both tax efficiency and financial stability.

As a CPA advising closely held businesses or professional service firms, you’ve likely helped clients navigate risk in many forms—from tax exposure to succession challenges. One often overlooked yet essential area of business risk planning is the loss of a critical team member whose expertise, leadership, or institutional knowledge is central to the company’s continued success.