Is a Cash Balance Plan Right for Your Client? A Comprehensive Guide for CPAs

Rohit Runyani, Co-Founder • September 4, 2025

For CPAs, questions about deductions and retirement planning reign supreme (especially around tax time), which is why we can’t wait to introduce you to your new best solution for the inquiring client: the 40-year-old cash balance plan. This is our favorite form of a defined benefit plan, and one we find consistently solves the challenges of retirement planning for business owners or self-employed 1099 filers.

But first, a note: CPAs who simply compile and file need not read on. This solution is for the CPA Strategist, particularly for small business owner-focused CPAs. Not all deductions are created equally, and in our opinion, the cash balance plan far exceeds any other deduction or savings vehicle you could present to your clients. Here’s what you need to know to elevate your practice through niche, custom strategies featuring a cash balance plan.

Cash Balance Plans vs. Traditional Retirement Savings

The overwhelming majority of people are familiar with the traditional defined contribution retirement system, which utilizes a 401(k), IRA, Roth, etc. However, many CPAs and business owners are surprised to find that the US tax code allows for alternative retirement plans in the form of defined benefits. If your client owns a business with even a modicum of profitability, or if they are a 1099 earner, they can access this much larger and more powerful retirement strategy.

Whenever possible, we unequivocally recommend that they utilize the tax savings and accumulation possibilities that a defined benefit plan can provide, especially as they near retirement.

A cash balance plan can be designed as either a defined benefit plan (a guaranteed, fixed dollar amount in retirement) or as a defined contribution plan (a known amount goes into the plan), providing the flexibility to tailor offerings to your client’s needs. This customizability makes cash balance plans especially valuable for high-earning business owners and self-employed individuals. With a 401(k), individuals often have some control over broad asset allocation ideas–the mix between stocks and bonds, etc.

Cash balance plans offer an even wider range of investment options than traditional retirement accounts, allowing a business owner or 1099-earner to tailor the plan’s assets to gain specific, risk-free, and guaranteed retirement assets. This is especially invaluable for clients who own businesses; if all of their risk is in their company, let’s use the tax code to guarantee a golden parachute.

Another advantage we love is that the deduction/contribution amount scales up alongside their age and income. It's easy to outgrow a 401(k), but you can’t outgrow your cash balance plan, once again highlighting why this is the ideal savings vehicle for high-income earners.

When to Recommend a Cash Balance Plan

So, is a cash balance plan right for every high earner or business owner who steps into your office? If they’re asking any of these questions, there’s a good chance that it will present the perfect solution.

“My 401(k) deduction is too small. What else is there?”

Let’s start with the issue at hand: a 401(k) simply will not be enough to replace working income for the successful business owner. This is a mathematical certainty.

One reason for this is the age-based limitations of the 401(k) system, particularly the older you are. True, thanks to catch-up contributions, traditional retirement strategies make some provisions for those above age 55 or so to put away a bit more money on the margin. However, even with these provisions, traditional retirement saving vehicles are nowhere near as beneficial for high-earning business owners as defined cash balance plans can be.

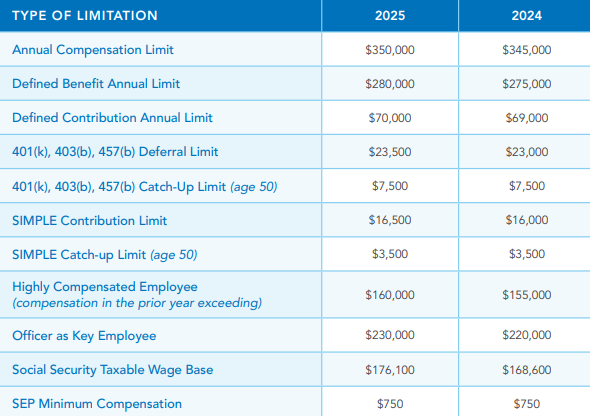

With a 401(k), your client’s 2024 contributions cap out at $23,000, and $30,500 for those aged 50 or older. With a traditional IRA, contribution limits for the same year are $7,000 and $8,000 for those 50 and older. Conversely,

contribution limits of a defined benefit plan scale along with a client’s income and age, since they are based on salary and length of employment. With a cash balance plan, contribution limits (and therefore, deductions) can be significantly higher, offering tax and retirement savings that far outmatch a 401(k) alone.

“Can I combine a cash balance plan with my 401(k)?”

YES! In fact, they are better together. Your clients can enhance their retirement savings by contributing to a 401(k)

and a cash balance plan (you cannot, however, contribute to a SEP IRA and a defined benefit plan simultaneously). Many are attracted to the idea of utilizing both retirement systems because each has its benefits and drawbacks.

One of the key advantages of combining a 401(k) with a cash balance plan is that business owners and 1099s gain access to a wider range of retirement products, specifically dividend-paying whole life insurance. Most of our partnered CPAs share a brief introduction to the client’s situation, and we work together to architect the best asset choices and flexibility for your client.

Another advantage, specifically for family-owned and small businesses, is that combining a cash balance plan with a 401(k) can be a valuable way to retain and attract key personnel and family members while rewarding all employees simultaneously. Life insurance, in this case, will serve a critical role in estate planning as well. This leads to the next question you may encounter.

“How can I generate tax-advantaged cash flow in retirement and limit taxes on wealth transfers?”

Implementing a defined benefit plan can generate significant possibilities beyond retirement savings and tax mitigation. As mentioned above, using a cash balance plan to purchase dividend-paying whole life insurance provides tax-deductible access to this incredible tool, which can be especially valuable in retirement and estate planning.

The power of life insurance in the context of retirement cannot be overstated–so much so that you can read more about it

here. It has no sequence of returns risk, and because the client doesn’t take money out of a life insurance policy, the cash value is collateralized as a loan instead. This is the only asset in the world that continues to grow as you consume it! Life insurance has no down years, and policy loans are tax-free.

Combining life insurance with a market portfolio creates tax-efficient cash flow solutions that change a retiree’s experience dramatically.

When it comes to transferring wealth from one generation to another, death benefits position life insurance as the most efficient asset. It is tax-free and immediate, whereas traditional types of inherited retirement accounts may trigger taxes, RMDs, or probate.

Incidentally, it also has a higher distribution rate than the traditional, market-based approach to retirement. To better understand the powerful use of life insurance in estate and retirement planning, we highly recommend Bryan Bloom’s three-book series,

Confessions of a CPA. There are many valuable resources on this subject; however, this may very well be the most easily understood and digestible series for retirement readiness. We find it so helpful that we send this series to all of our clients and discuss it whenever possible!

“I hate owing so much in taxes! How can I owe less?”

There are incredible tax benefits associated with implementing a cash balance plan due to the fact that it’s considered a “top-line” deduction. What does that mean? If a business earned $1 million in top-line revenue and we implemented a $300,000 per year defined benefit plan, it would be taxed as if it earned $700,000. Business owners and high-income 1099-earners alike can greatly benefit from the tax advantages of a cash balance plan, which include:

- An immediate deduction, including a deduction for last year, for “buying” their retirement. Contributing to a cash balance plan is a corporate expense; therefore, it lowers the taxable income to the individual or the entity.

- Contribution limits and write-offs that increase with their income. Again, this is a key differentiator between the defined benefit system and the traditional 401(k) system.

- Unique benefits for those nearing retirement, or aged 45 and older. The older they are, the more they can contribute. As we briefly touched on, this creates an unparalleled opportunity to offset gains during peak earning years, solving retirement planning and tax mitigation needs.

- Magic in the asset menu. Cash balance plans allow your business owner clients the unique opportunity to acquire dividend-paying whole life insurance with pre-tax dollars.

Like your clients, the Fusion Strategies team is made up of entrepreneurs. Like your clients, we’re all-in on our business and working relentlessly. Most of the clients introduced to Fusion Strategies share that they reinvested in the business at the expense of time or capital put into a retirement plan; they feel behind. A cash balance plan can help get them caught up and gain a deduction right alongside it. In fact,

one year can help you catch up on almost 2 decades of contributions to common qualified plans.

Cash balance plans provide an elegant, tax-advantaged solution to this classic entrepreneurial dilemma. They allow for such large contributions that they can effectively “superfund" a retirement in just a handful of years while getting a sizable deduction.

“What’s the best way to maximize deductions on business investments?”

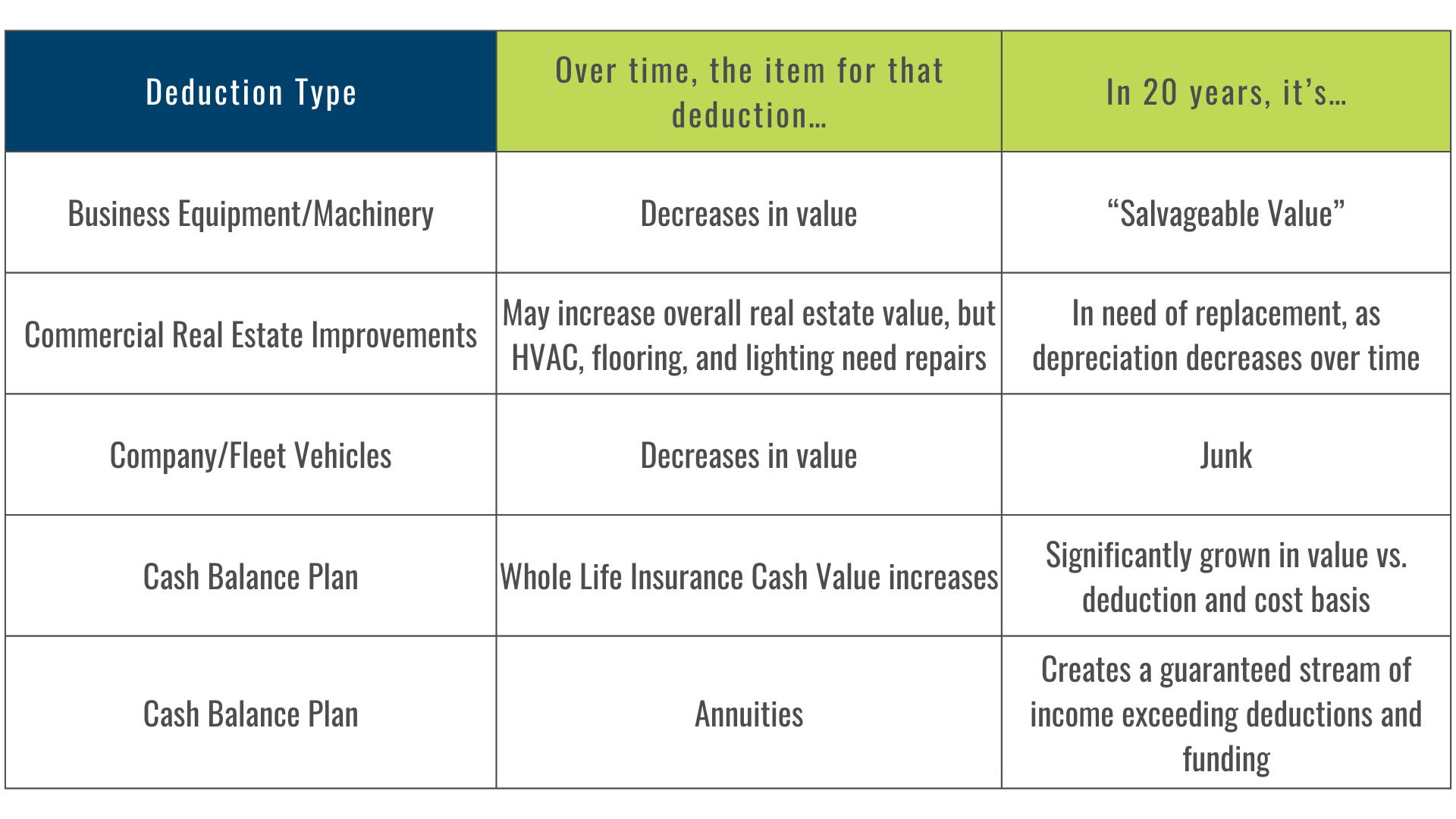

We prefer to take deductions to buy growing assets, not take deductions for assets that decrease in value over time (such as heavy vehicles, amortized furniture, etc.). For this reason, cash balance plans are our favorite type of deduction! Consider the longevity of different deductions a business owner may take:

“I’m nearing retirement, but behind on saving. Is it possible to catch up?”

Perhaps only wine and cash balance plans get better with age! As stated previously, the closer your client is to retirement, the more they can contribute to a cash balance plan.

This allows business owners to maximize retirement savings during peak earning years without being hindered by contribution limits, effectively turning age into an asset. Planholders can put anywhere from 7 to 20 times more capital into a defined benefit program than traditional 401(k) or IRA programs allow. In some cases, contribution limits can reach as high as $500,000 per year, depending on age and income!

For example, in 2024, a 55-year-old earning $345,000 can put $30,500 into a 401(k), including a catch-up provision. In that same year, our 55-year-old can put $440,382 into a cash balance plan structured as defined benefits.

Those close to retiring can utilize this age-based contribution feature to save a substantially higher amount of capital while recognizing a significant deduction. Again–we love deductions for assets. With traditional retirement savings vehicles, an annual contribution cap of $27,000 means it would take a while to reach a $305,000 balance in the retirement plan. However, by implementing a cash balance plan, that sum can be invested and put to work toward retirement in just one year. The client can continue to do this each year, for at least three years, for as long as they’re operating the business and receiving 1099 or non-W2 income.

By combining a traditional and cash balance program for your client’s business, you help them receive higher deductions along with a substantially larger retirement corpus. The larger nest egg will be earned with less risk. This is a strategy we’ve successfully implemented with many individuals in their late 70s as well; age is your friend here.

Let’s examine how this could play out in a common situation we see. In addition to the substantially larger contribution amounts that come with the strategic implementation of a defined benefit plan, a 55-year-old can not only superfund their retirement but also begin to take care of business succession and estate planning needs. This can be done by purchasing risk-free assets like annuities and whole life insurance while implementing a strategically crafted cash balance plan. Life insurance is unique in that once it is purchased via tax deduction in a defined benefit plan, the policyholder can then own the asset personally, utilizing its unique estate planning and retirement benefits (read more about them

here). To summarize, this strategy has allowed the hypothetical individual to:

- Make up for delayed retirement planning

- Enjoy substantial tax deductions

- Establish guaranteed income for life through an annuity

- Create liquidity for themself or their business through life insurance

- Protect their estate and beneficiaries

- Provide for the future of their business

Since business owners have unique needs–liquidity, estate planning, business succession planning, and managing taxes and cash flows–defined benefit plans are one of the best tools for meeting some combination of each of the aforementioned strategies.

This is why we love defined benefit plans for business owners. As we like to say,

“You can turn corporate expenses into personal assets with a defined benefit plan.”

Ready to Become a CPA Who Creates Options?

The single most important thing your business owner or self-employed client can do is work with a firm that specifically specializes in the design, implementation, and maintenance of defined benefit plans, especially cash balance plans. Many financial advisors are familiar with them but do not have the necessary compliance, tax, and risk acumen to properly design and implement these strategies. When structured and managed correctly, defined benefit plans can offer:

- Annual, level tax deductions

- A substantially larger retirement balance

- Potential estate planning benefits

- Risk mitigation for a portion of your assets, allowing you to extend the longevity of other assets

- An enhanced corporate culture and the ability to retain key employees

In addition to our deep expertise in implementing defined benefit plans, specifically cash balance plans, one of the most important benefits of working with Fusion Strategies is our cultural ethos on education and empowerment. Success follows a willingness to learn and collaborate–something we foster in every client interaction and regularly leverage to help CPAs expand and enhance their services.