Legacy Banking and Debt Management: What CPAs Need to Know

Rohit Punyani, Co-Founder • August 7, 2024

Helping High-Net-Worth Clients Rethink Liquidity, Leverage, and Policy Structuring in a Post-Connelly Landscape

For CPAs working with high-net-worth clients, managing debt, liquidity, and asset growth requires more than just conservative planning. Increasingly, clients are exploring more integrated strategies—especially those that combine asset growth with tax efficiency and flexible access to capital.

One such approach gaining traction is legacy banking, which leverages dividend-paying whole life insurance policies as a financial tool—specifically as an alternative method for funding major obligations, managing debt, and even bolstering estate planning strategies.

With recent attention around the Connelly v. United States Supreme Court decision, this strategy has moved from niche planning to front-page relevance, especially for CPAs involved in business valuations, buy-sell agreements, and tax-sensitive liquidity planning.

What Is Legacy Banking?

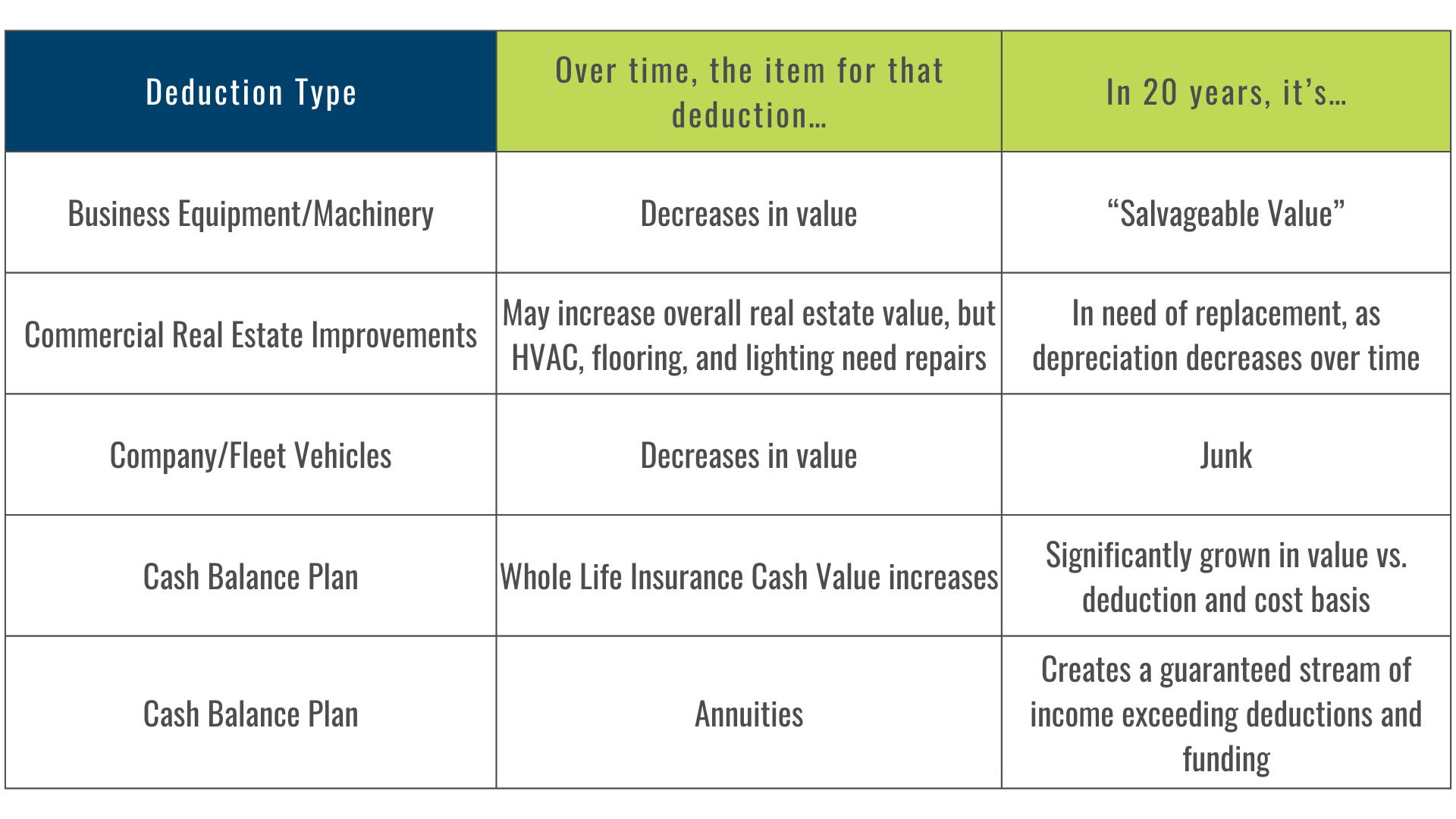

Legacy banking is the practice of building and accessing the cash value of a permanent life insurance policy—particularly whole life insurance issued by a mutual carrier—to create liquidity for personal or business needs. Unlike traditional savings or investment accounts, the policy’s cash value continues to grow—even while the client accesses it via tax-free policy loans.

This structure allows clients to:

- Maintain compounding growth inside the policy

- Access cash without triggering a taxable event

- Manage debt with potential interest arbitrage

- Support estate liquidity or succession objectives

For clients who would otherwise pay down debt using after-tax savings, this strategy may offer a more efficient and tax-aware alternative.

Why This Matters Now: Connelly v. United States

The Connelly ruling has sparked renewed attention around the valuation and tax treatment of life insurance policies in buy-sell agreements. The decision highlights the need for careful policy structuring and valuation alignment, particularly in family-owned or closely held businesses.

For CPAs advising on shareholder agreements or business succession plans, this ruling underscores:

- The importance of correctly documenting ownership and beneficiary designations

- The need to clarify whether a policy’s death benefit inflates enterprise value

- The strategic advantage of using outside trust ownership (such as an ILIT) to potentially manage tax exposure

Legacy banking strategies—when coordinated with proper legal and tax structuring—may now present both a planning opportunity and a compliance imperative.

Key Financial Advantages for Clients

CPAs should be aware of the primary benefits this strategy offers, especially for clients managing complex financial obligations or looking to enhance liquidity without eroding long-term growth:

- Tax-deferred growth: The policy’s cash value compounds without annual tax reporting.

- Tax-free access: Policy loans are not considered income and do not require credit approval or underwriting.

- Uninterrupted compounding: Even when clients borrow, the underlying cash value continues to earn dividends and guaranteed interest.

Interest rate arbitrage: In some cases, clients can borrow against the policy at a lower rate than their external debt, preserving capital and enhancing financial flexibility.

Strategic Application for CPAs and Clients

Here’s how CPAs might help clients apply legacy banking principles:

- Debt optimization: A client with 8% personal or business debt may use a policy loan at 5% to eliminate that higher-interest obligation, redirecting payments toward replenishing their policy.

- Liquidity replacement: Rather than drawing from taxable investment accounts to fund a large purchase, a client borrows from their policy while keeping other assets invested.

- Tax bracket management: In retirement, policy loans may supplement income without impacting adjusted gross income or Medicare brackets.

- Estate liquidity: Policies structured within trusts may provide a source of tax-free liquidity for estate taxes, reducing the need to liquidate illiquid business or investment holdings.

Considerations and Best Practices

Legacy banking is not a short-term tactic—it’s best suited for long-term, financially disciplined clients.

CPAs should guide clients to:

- Work with top-rated mutual insurers offering consistent dividend performance and strong guarantees.

- Avoid over-borrowing or underfunding, which could compromise policy performance or trigger a taxable event.

- Maintain careful loan tracking and repayment schedules.

- Ensure the policy is properly structured for intended tax treatment—particularly if used in a business or estate planning context.

A Note on Policy Selection

Not all permanent policies are suitable for this strategy. CPAs should collaborate with licensed professionals to ensure:

- Policy design supports high early cash value accumulation

- Modified Endowment Contract (MEC) status is avoided unless intentional

- Ownership and beneficiary structures are consistent with planning intent

Looking Ahead

Legacy banking represents a shift in how high-net-worth individuals manage capital. As a CPA, your role in evaluating its viability for a client involves balancing risk, liquidity needs, estate planning goals, and tax efficiency.

Done correctly, this strategy allows clients to maintain control of their capital while enhancing long-term compounding—without disrupting core assets or triggering unintended tax consequences.

At Fusion Strategies, we partner with CPAs to design, implement, and manage legacy banking strategies that integrate seamlessly into the client’s broader financial plan. Our expertise includes navigating legal developments like Connelly, ensuring every plan is compliant, tax-smart, and well-aligned with the client’s objectives.

Let’s Discuss Your Clients’ Opportunities

Email: team@fusion-strategies.com

More strategies: https://www.fusion-strategies.com/blog