Using Life Insurance to Fund Real Estate: What CPAs Should Know

Rohit Punyani, Co-Founder • December 13, 2024

A Planning Strategy for Real Estate Investors, Business Owners, and High-Income Clients

Tax accountants are often the first call when clients evaluate how to finance real estate investments—particularly those interested in leveraging tax-advantaged liquidity and minimizing opportunity costs. One lesser-known but increasingly relevant tool in this space isdividend-paying whole life insurance, specifically throughpolicy loans against cash value.

Used correctly, this strategy can enhance real estate acquisition, preserve long-term compounding, and integrate efficiently with estate and liquidity planning. For clients in high tax brackets or who’ve exhausted traditional sources of leverage, this may offer a meaningful strategic advantage.

The Core Concept: Borrow Against, Not From

Most real estate purchases require a down payment, typically 5–20% of the property value, depending on the type and location of the property. That capital usually comes from savings, home equity, or a line of credit.

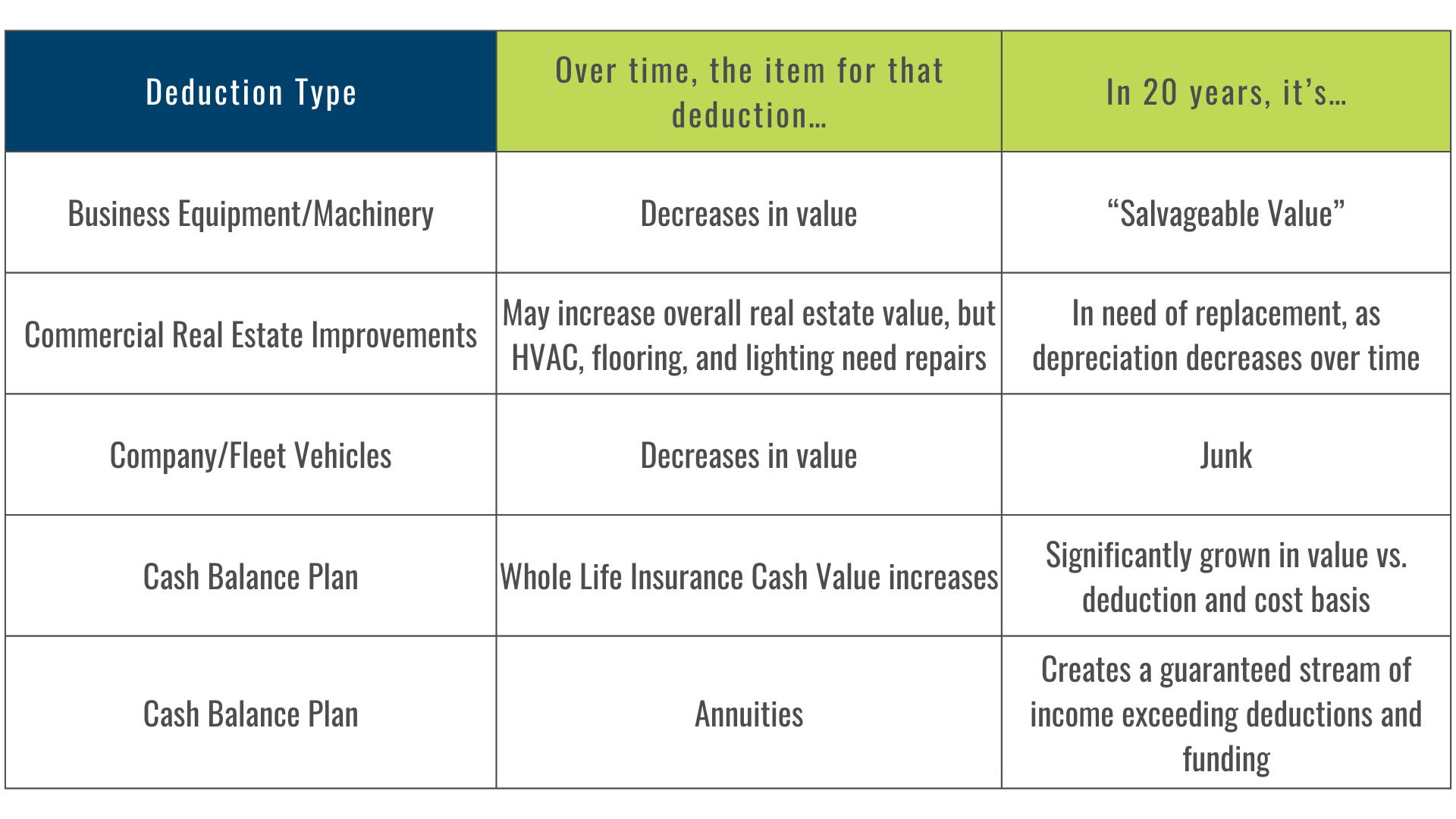

However,using savings depletes compounding capital. Once deployed, that capital ceases to grow. The investor must then re-save from zero, often over several years.

In contrast, a properly structured whole life policy allows the client to borrow against the policy’s cash value, not withdraw it. The cash remains in the policy, growing tax-deferred, while the loan creates liquidity for the investment. This is what makes the strategy part of what’s commonly referred to aslegacy banking.

Key Features for Planning

Policy loans offer the following benefits:

- No credit underwriting or approval

- No fixed repayment schedule

- Tax-free loan proceeds

- Continued compounding of full cash value, even with a loan outstanding

Compared to traditional financing, policy loans can offer lower friction, fewer conditions, and improved capital efficiency—particularly valuable for clients seeking rapid execution on competitive real estate deals.

Structuring Considerations: Only Whole Life

This strategy requires careful policy design. At Fusion Strategies—and based on our work with CPAs and investment professionals—weonly recommend dividend-paying whole life insurance issued by mutual insurance companies for this purpose.

Wedo not advise the use of Indexed Universal Life (IUL) or Variable Universal Life (VUL) for real estate-based liquidity. Here’s why:

- IULs expose clients to market risk and interest rate volatility

- Many IULs and VULs operate on a one-year term chassis, which increases cost of insurance over time

- Poor market performance can lead to policy lapses or the need for unexpected capital infusions

- Cost structures and cap rates are often misunderstood or poorly disclosed

- These policies lack the stable cash value and guaranteed loan access that whole life provides

By contrast, dividend-paying whole life provides:

- Level premiums

- Guaranteed cash value growth

- Consistent annual dividends (historically reliable, though not guaranteed)

- Predictable borrowing terms and policy performance

This level of predictability and capital preservation is essential when integrating life insurance into a real estate strategy.

Tax Treatment and Strategic Advantages

CPAs advising on this strategy should note:

- Policy loans are not taxable under current law

- Loan proceeds do not appear as income and do not affect AGI, AMT exposure, or Medicare thresholds

- Interest on policy loans is not deductible—but the tradeoff is full tax-deferred growth of the cash value

- Death benefits pass income-tax-free and can be used to repay outstanding loans or fund estate liquidity

- In many jurisdictions, cash value is protected from creditors and considered bankruptcy-remote

This tax treatment makes policy loans an efficient bridge for funding acquisitions, especially when traditional bank financing is either too restrictive or inefficient.

Use Case: Real Estate Down Payments

Consider a client preparing to acquire a $1.5M commercial property with a required $300K down payment. Rather than pulling from invested capital or selling appreciated securities, the client borrows $300K against a $500K cash value life insurance policy at 5.5% interest. Their cash value continues to grow (typically at 4–5%), and the interest is repaid over time using rental income from the property.

The client maintains full ownership of both assets—the policy and the property—and can later redeploy the capital for future investments or legacy planning. No tax is triggered, and no liquidity is lost.

Risks and Considerations

While policy loans provide flexibility, there are planning risks CPAs must help clients account for:

- Outstanding loans reduce the net death benefit available to heirs

- Excessive borrowing without repayment can erode cash value and result in policy lapse

- Loan interest must be managed, even if there is no formal repayment schedule

- Policy performance still depends on proper funding and disciplined maintenance

In short, policy loans should be treated as leverage—managed intentionally with a repayment or servicing plan.

Estate Planning Benefits

For clients with estate planning goals, integrating a whole life policy into a real estate portfolio offers additional advantages:

- Ensures liquidity for heirs at death, potentially offsetting debt or transfer taxes

- Allows continued real estate ownership without forced liquidation

- Supports multi-generational planning and charitable bequests

- Can be structured using an ILIT to exclude death benefit from the taxable estate

In this way, the same policy that funded property acquisition can later fund estate liquidity, buyouts, or trust-based distributions.

Final Thoughts for CPAs

Life insurance is not just about risk transfer—it can be a capital-efficient financial instrument when properly structured. For clients who invest in real estate, whole life insurance offers:

- A source of tax-free, flexible liquidity

- Uninterrupted compounding of capital

- Enhanced estate planning options

- Simplified capital sourcing for long-term wealth-building

At Fusion Strategies, we work closely with CPAs and their clients to ensure each policy is designed for its intended function—whether that’s liquidity, estate liquidity, asset protection, or leverage for real estate acquisition.

Let’s Collaborate on Smart Liquidity Strategies

Contact Us: https://www.fusion-strategies.com/contact

Blog and planning resources:https://www.fusion-strategies.com/blog