Help Clients Stop Leaving Money on the Table: How Cash Balance Plans Can Boost Their Wealth

Rohit Punyani, Co-Founder • April 9, 2024

A Strategic CPA Guide to Shielding Client Income Through Pre-Tax Retirement Planning

Cash Balance Plans: A Tax-Efficient Strategy for High-Income Clients

As a CPA, your clients count on you to help them grow and protect wealth—especially through smart tax deferral strategies. One often-overlooked tool is the cash balance plan, a powerful retirement vehicle designed for high-earning business owners and 1099 contractors.

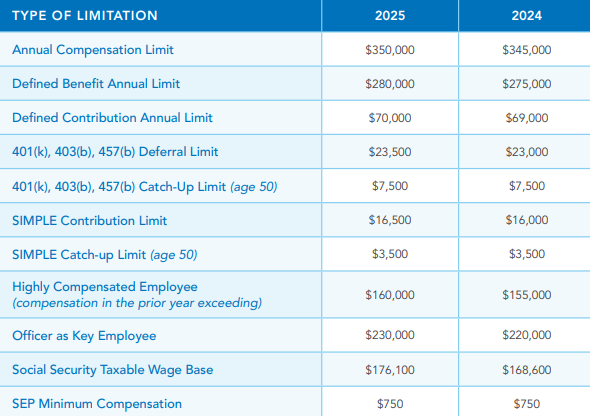

Unlike 401(k)s, which have limited annual contributions, cash balance plans allow contributions up to 10x higher, depending on age and income. This gives your clients the opportunity to significantly reduce taxable income while building retirement assets.

Understanding Cash Balance Plans and Why They Matter for Your Clients

Cash balance plans are employer-sponsored defined benefit plans, but they look and feel like a defined contribution plan to the participant. They’re expressed as hypothetical account balances, making them easy to understand and track.

Benefits your clients will care about:

- Massively higher contribution limits vs. 401(k)s (especially for older, high-earning business owners)

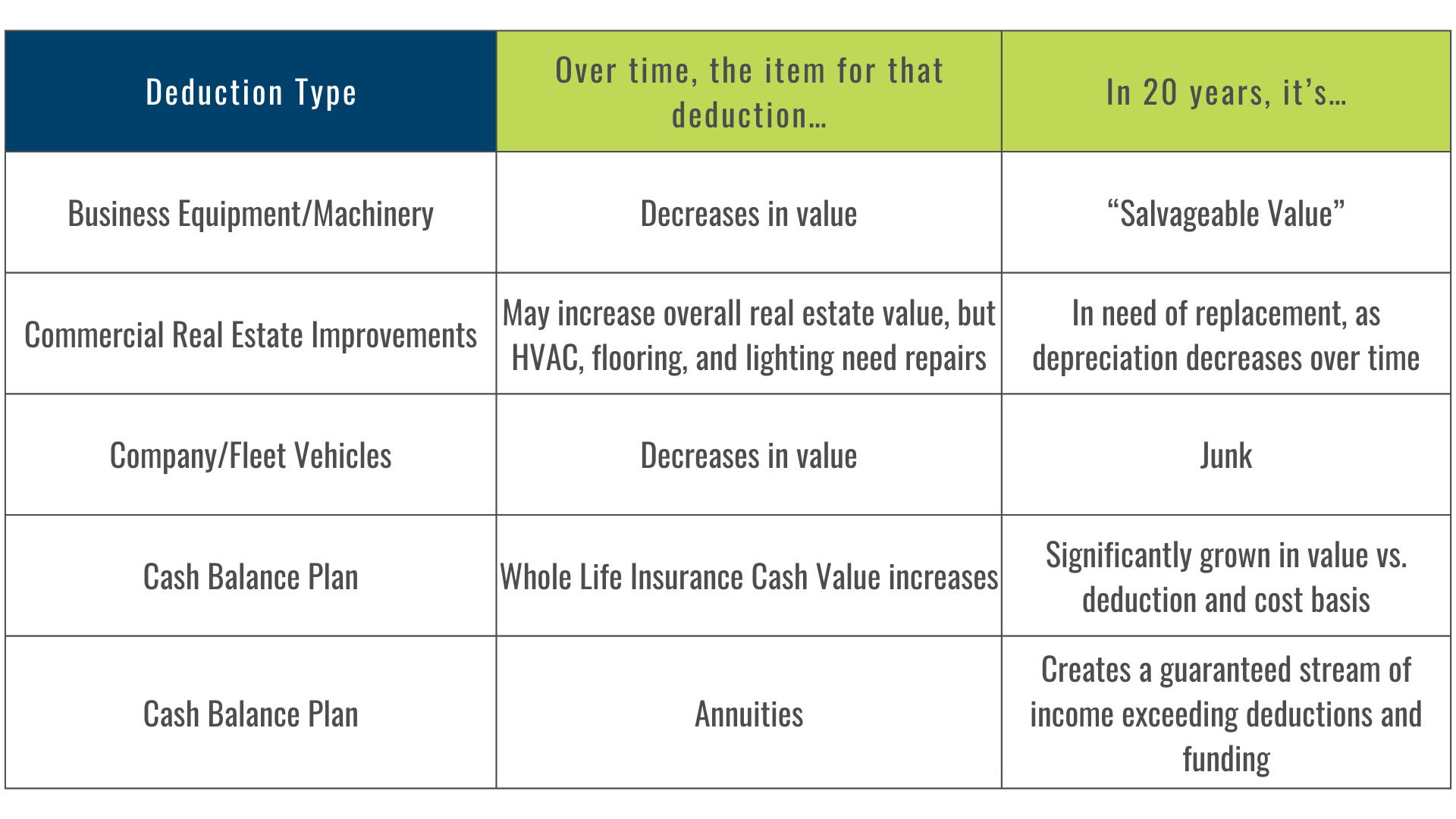

- Pre-tax deductions that reduce current-year income

- Optional life insurance funding within the plan—providing tax-deferred growth, liquidity, and estate planning advantages

- Exit strategies like “superfunding” an IRA at plan termination

CPAs can use these tools to dramatically improve after-tax cash flow and retirement readiness—especially for clients with large year-end income or one-time windfalls.

Check out our other post on Understanding DB vs. DC Plans for Business Owners.

Implementing a Cash Balance Plan: What CPAs Should Know

Helping clients implement a cash balance plan doesn’t have to be complicated. Here’s a breakdown of what to expect:

Funding Level Determination

- Contribution limits are based on age, income, and structure. Older clients can typically contribute significantly more.

Plan Design & Customization

- The plan can be tailored to business goals (e.g., higher contributions to the owner, strategic benefits for employees).

Third-Party Administration (TPA)

- A TPA is engaged to manage the plan, file Form 5500, and ensure IRS compliance. Setup fees are similar to a 401(k).

Deductibility Across Structures

- Cash balance plans are flexible—useful across C Corps, S Corps, partnerships, LLCs, and sole proprietorships. TPA and setup costs are fully deductible.

Key Takeaways for CPAs Advising Business Owners

Higher deductions = lower current-year taxes

Contributions to cash balance plans can sharply reduce taxable income—ideal for clients with high Schedule C or K-1 income.

Easier to understand than traditional DBs

Clients get a “balance” to track, making the concept less abstract than pensions.

Life insurance integration

Inside the plan, life insurance can grow tax-deferred and be distributed in-kind tax-free, offering added retirement or estate planning value.

Exit strategy built in

Upon plan termination, clients roll their balance into IRAs—preserving tax deferral.

Time-Sensitive Tax Tip for Your Clients

Many CPAs don’t realize this:

Cash balance plans can be funded for the previous tax year if formed in Q1 (or even into Q2) of the current year.

Example: A plan created in early 2024 can still provide a 2023 tax deduction—if finalized by July 15, 2024 (the final extended filing deadline).

Encourage clients who are filing on extension to consider this move before it’s too late.

Let’s Partner to Build a Custom Plan for Your Clients

At Fusion Strategies, we collaborate with CPAs like you to custom-design and administer these plans. Whether you’re helping a solo 1099 client or a growing S Corp with several employees, we provide turnkey solutions that simplify implementation while maximizing benefit.

Contact us today at team@fusion-strategies.com to explore how a cash balance plan could strengthen your client’s tax strategy and retirement readiness.