Whole Life Insurance as a Strategic Wealth Tool for Your Clients

Rohit Punyani, Co-Founder • March 19, 2024

Whole Life Insurance as a Strategic Wealth Tool for Your Clients

What Every CPA Should Know About Leveraging Life Insurance for Tax Efficiency, Retirement, and Estate Planning

As a CPA, your clients trust you to provide insight not only on taxes but on long-term wealth preservation and strategic planning. Increasingly, high-income earners and business owners are seeking tools that offer stability, tax advantages, and liquidity—without relying solely on volatile markets or tax-deferred accounts.

One often-overlooked yet highly effective strategy involves dividend-paying whole life insurance policies issued by mutual insurance companies. These policies offer your clients significant financial benefits beyond a death benefit—including tools for tax planning, liquidity, and wealth transfer.

Let’s explore how this strategy can support the goals of your most financially engaged clients.

1. Policy Loans: Access to Tax-Free Liquidity

Whole life insurance policies accumulate cash value over time, which your client can access via policy loans. These loans:

- Do not require credit checks or underwriting

- Are not taxable (provided the policy remains in force)

- Can be used for any purpose—business investment, personal liquidity, or emergency needs

Policy loans are particularly attractive for high-net-worth individuals and business owners who need access to capital without triggering taxable events or disrupting other investment holdings.

2. Tax Deferral and Tax-Free Withdrawals

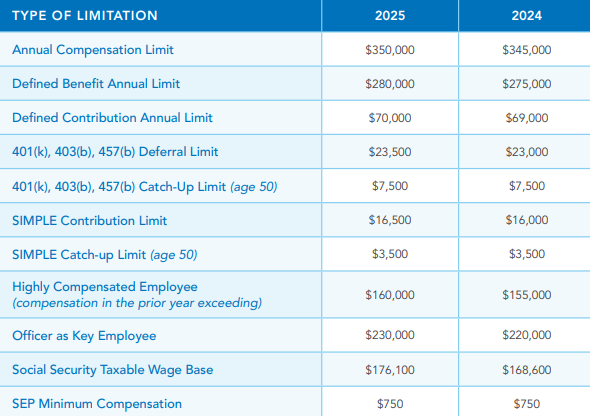

Whole life insurance offers powerful tax advantages, especially when used in tandem with traditional retirement planning:

- Cash value grows tax-deferred, similar to a Roth IRA

- Policy loans are not considered taxable income

- Withdrawals up to basis (premium contributions) are generally tax-free

- The death benefit passes income-tax free to named beneficiaries

For clients who have maxed out traditional retirement vehicles or are concerned about future tax increases, this creates a parallel, tax-efficient asset they can access during retirement.

3. Retirement Planning Without Market Risk

Unlike market-based investments, the cash value in a whole life policy is not subject to equity volatility.

This is especially beneficial for clients approaching retirement who prioritize capital preservation and predictable returns.

- Guaranteed interest accrual

- Annual dividends (not guaranteed, but historically consistent with top-rated mutual insurers)

- Protected downside with zero market exposure

As a CPA, you can help clients integrate whole life into a broader retirement strategy—particularly to reduce reliance on qualified plans that may be exposed to future tax risk or market downturns.

4. Efficient Wealth Transfer and Estate Liquidity

Life insurance plays a vital role in estate and succession planning, especially for clients with illiquid estates (e.g., business interests, real estate portfolios)

Asset Protection: In many jurisdictions, life insurance cash value and death benefit may be shielded from creditors, offering protection for clients in high-liability professions.

Liquidity Provision: Life insurance delivers immediate liquidity to beneficiaries—often within weeks—bypassing probate and providing funds to:

- Cover estate taxes

- Settle debts

- Maintain family living standards

- Fund business succession or buy-sell agreements

As a CPA, you understand how essential liquidity can be in reducing the forced liquidation of legacy assets just to satisfy tax or cash flow demands.

5. Advanced Planning: ILITs and Legacy Structuring

For clients with larger estates, pairing a policy with an Irrevocable Life Insurance Trust (ILIT) removes the death benefit from the taxable estate. This strategy:

- Preserves the full value of the life insurance for heirs or philanthropic causes

- Helps mitigate exposure to state or federal estate tax

- Adds structure and legal clarity to asset distribution

When coordinated with you as the client’s tax advisor, this can significantly reduce estate tax exposure and maintain control over long-term legacy goals.

Why CPAs Are Reconsidering Life Insurance in Strategic Planning

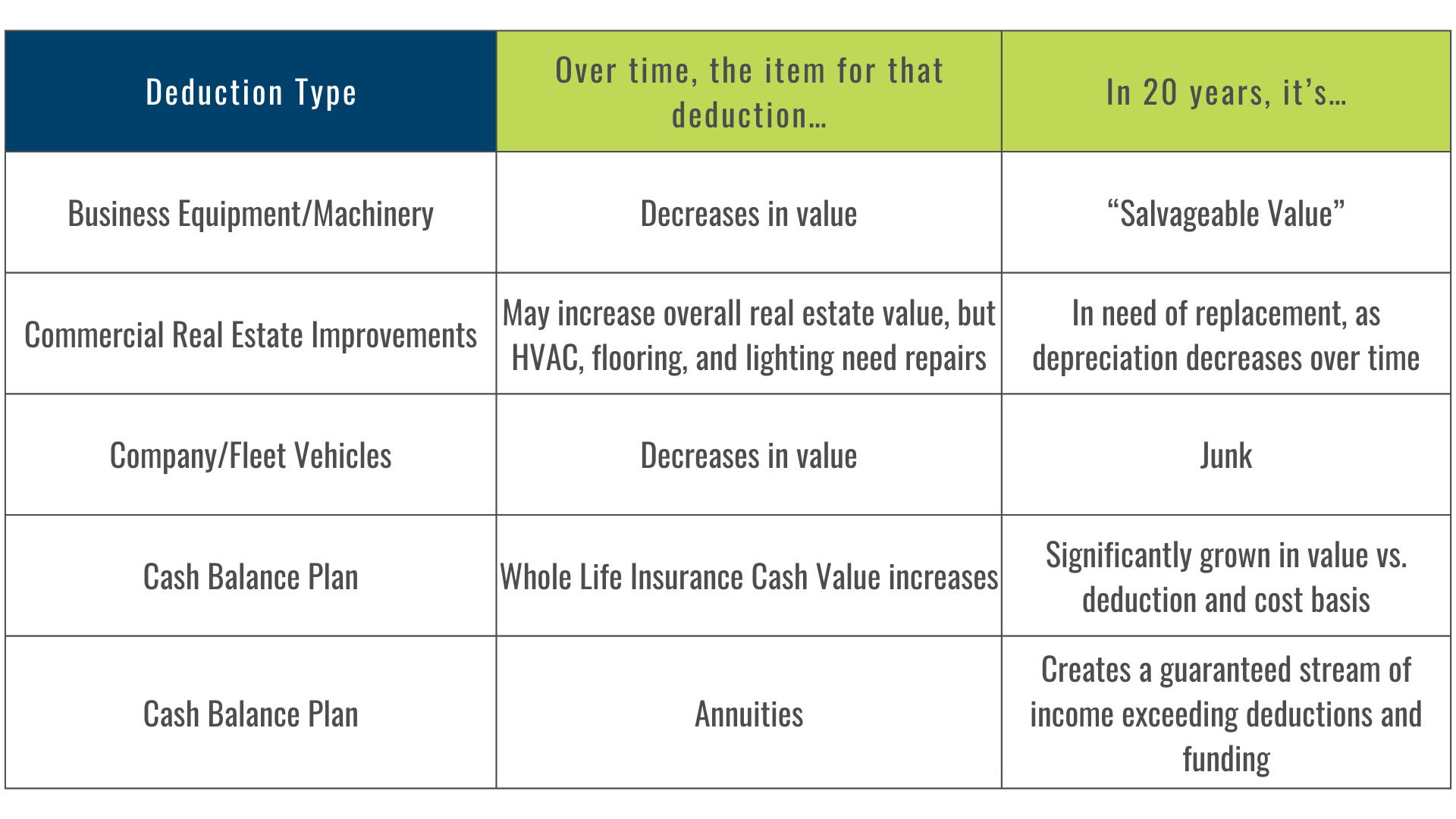

In today’s environment, whole life insurance is no longer just a protection product—it’s a multi-functional financial asset:

- Tax-advantaged growth and withdrawals

- Retirement stability in volatile markets

- Creditor protection and wealth transfer efficiency

- Liquidity to preserve other appreciating assets

These features make it a useful complement to traditional tax and retirement planning strategies—particularly for high-earning professionals, entrepreneurs, or clients who’ve maxed out tax-deferred accounts.

Partner with Fusion Strategies

At Fusion Strategies, we work directly with CPAs to help structure whole life policies that integrate cleanly into your clients’ tax and estate plans. Whether you’re exploring liquidity planning, buy-sell funding, or tax-free retirement income, our team can help you design solutions that serve your client’s needs—and elevate your role as their most trusted financial partner.

Let’s collaborate to turn whole life insurance into a strategic advantage for your clients.

Reach out to us: Team@fusion-strategies.com