Guiding Clients Through Estate Planning: A Strategic Asset for CPAs

Rohit Punyani, Co-Founder • February 14, 2024

Helping Your Clients Protect and Direct Their Legacy with Confidence

As a CPA, your role often extends beyond tax filings and compliance—you’re a trusted advisor on matters of long-term wealth, retirement, and legacy. One area where your guidance is especially critical is estate planning.

Whether you’re advising a high-net-worth business owner or a single client with philanthropic ambitions, you’ve likely heard the same refrain:

“Estate planning is too complicated.”

“I’m not wealthy enough for that.”

“I don’t have heirs, so it doesn’t apply to me.”

In reality, none of these assumptions are true. As you know, estate planning isn’t just for billionaires. It’s for anyone who wants to control how their assets are transferred, reduce unnecessary tax exposure, and ensure their wishes are honored—regardless of family status or net worth.

Three Common Estate Planning Myths—And What You Can Do About Them

Many clients delay estate planning due to misconceptions like:

- “It’s too complex.” In reality, a basic plan may only require core documents: a living will, powers of attorney (financial and medical), guardianship designations, and current beneficiary listings.

- “It’s only for the ultra-wealthy.” Every client has assets—whether it’s real estate, business interests, or retirement accounts—that require direction.

- “No heirs means no need.” Clients without direct heirs still benefit immensely from estate planning, particularly if they want to support charities, institutions, or causes they care about.

By proactively addressing these myths, you help clients avoid probate delays, tax inefficiencies, and unintentional disinheritance.

Life Insurance as a Planning Tool — More Than Just a Death Benefit

A strategic estate plan often includeslife insurance as a core asset. For clients with illiquid estates (e.g., business ownership, real estate portfolios, or investment properties), life insurance can provide critical liquidity when it’s needed most—without requiring asset liquidation.

Here’s what CPAs should consider:

- Tax-Free Liquidity: Properly structured life insurance proceeds can fund estate taxes, final expenses, or distributions without triggering additional tax burdens.

- Avoiding Forced Sales: Life insurance allows beneficiaries to retain appreciating assets—rather than selling under duress to cover obligations.

Business Continuity: In closely held businesses, life insurance can fundbuy-sell agreements or provide a financial bridge for succession planning.

Enhancing Protection with an ILIT (Irrevocable Life Insurance Trust)

For clients with larger estates or potential estate tax exposure, combining life insurance with anIrrevocable Life Insurance Trust (ILIT) can offer substantial protection:

- If the life insurance policy is owned by the ILIT—not the individual—the death benefit is excluded from the taxable estate.

- This structure keeps the policy proceeds shielded from estate taxation and protects assets for designated beneficiaries or organizations.

This approach is especially useful for:

- Clients in states with estate or inheritance taxes.

- Clients concerned about creditor protection.

- Philanthropically inclined clients who want control over charitable distributions.

Introducing Legacy Banking: A Holistic Strategy

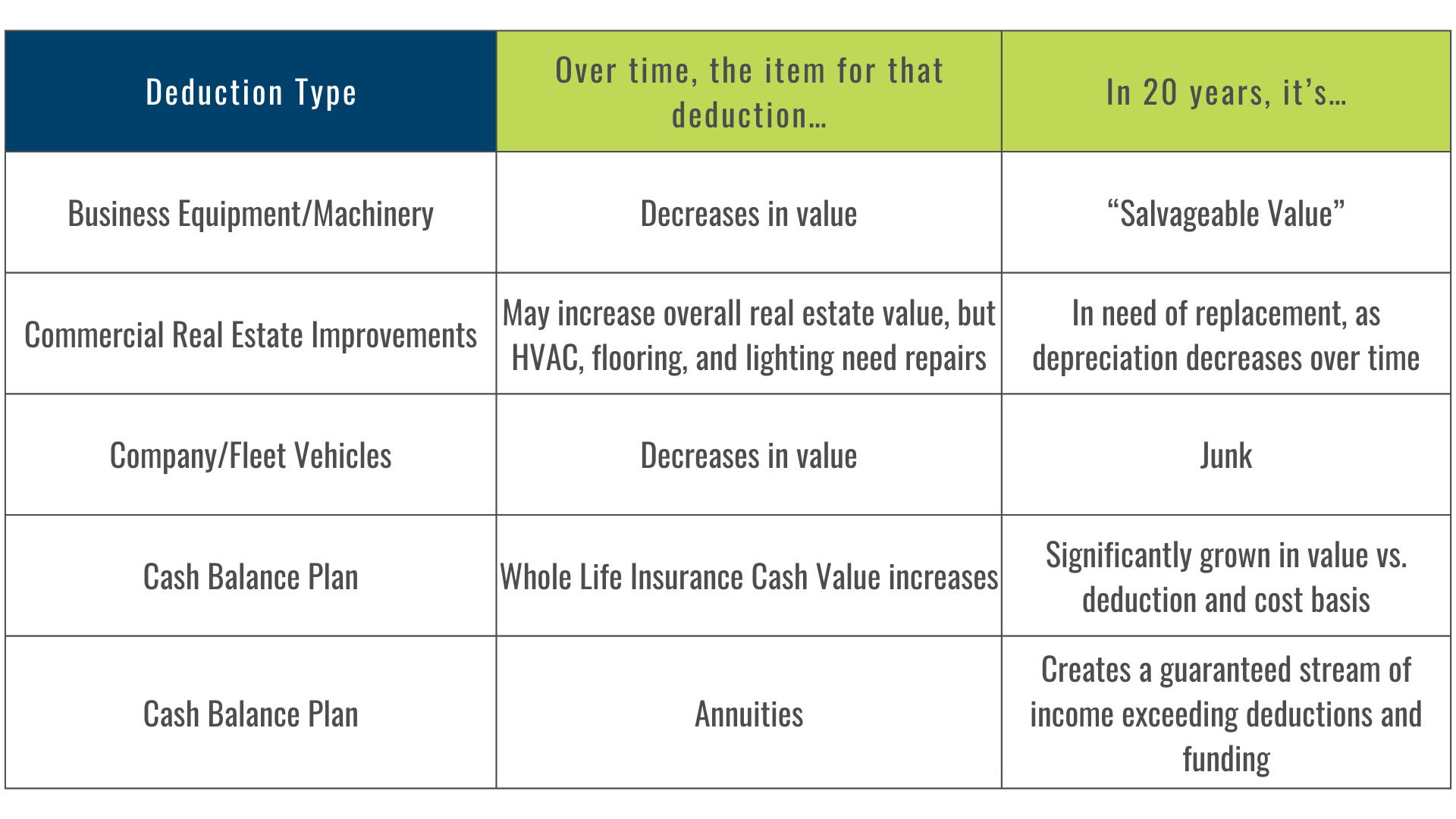

We often introduce clients and CPAs toLegacy Banking—a comprehensive approach that combines life insurance, retirement planning, and estate protection in one integrated strategy.

When implemented correctly, Legacy Banking can provide:

- Tax-free retirement income via policy loans.

- Asset protection through policy structure.

- Liquidity to address future obligations without asset liquidation.

- Intergenerational wealth transfer, preserving family businesses or supporting long-term charitable goals.

Partnering with Fusion Strategies

At Fusion Strategies, we work collaboratively with CPAs to design estate planning strategies that fit seamlessly within a client’s broader financial plan. Whether it’s integrating life insurance into an estate strategy, helping fund a buy-sell agreement, or maximizing charitable impact, we’re here to provide planning support and implementation expertise.

If you have clients who could benefit from a structured estate strategy—especially one that reduces tax exposure and enhances control—we’re ready to collaborate.

Let’s talk about how we can help your clients protect their legacy and make your advisory role even more impactful. Get in Touch! www.fusion-strategies.com/contact