How Mutual Whole Life Insurance Helps Business Owners Avoid High-Interest Loans

Rohit Punyani, Co-Founder • July 1, 2025

Dividend-paying mutual whole life insurance is perhaps one of the most misunderstood and underutilized tools for business owners and 1099 earners, making it an invaluable addition to your CPA business offerings. So many think of this insurance simply as an expense today that could provide a death benefit tomorrow. However, we continue to argue that the name “life insurance” doesn’t capture the full value of this tool, particularly the valuable living benefits for business owners and 1099 earners.

As a CPA, you’re often asked about planning, risk, and strategy; for all intents and purposes, you’re filling the role of outsourced CFO. At base, your clients want to know how to grow their business, and you know that doing so requires optimal use of cash flow and debt. We believe that key man or key person insurance with whole life insurance can help them do just that. Educating your clients on this underutilized tool, as well as helping them properly implement it, provides a valuable added service for your CPA business.

Today, we delve into yet another “life” benefit of whole life insurance, specifically for business owners concerned about losing a key person from their operations. We cover the accretive banking benefits available to businesses through the strategic use of key person insurance, concluding with practical recommendations for business owners to start using this valuable asset.

Key Person Insurance: More than Coverage

Whether you’re a business owner or a CPA advising business owners, the importance of mitigating business founder, owner, or key personnel risk cannot be overstated. Take, for example, key person insurance, formerly known as key man insurance: a life or disability insurance policy that a business purchases to cover a vital employee. This employee is someone whose knowledge, skills, or overall contributions are essential to the company’s success. Without them, the business would be materially impacted. At first glance, it seems like paying to protect the business is an expense. However, you can structure the policy to function as a line of credit, multiplying the benefits of an already worthwhile investment!

However, before we dive into the details of using key person whole life insurance as an alternative to business loans, it’s essential to understand that there are two major policy types: term insurance and convertible term insurance. Term insurance is renting, whereas convertible term insurance is renting with an option to buy. Term insurance cannot become a line of credit. Convertible term, on the other hand, can be converted into a permanent, liquid asset that protects the business and strengthens the balance sheet.

These key distinctions highlight where Fusion Strategies differs, and where so many fail to maximize the value of this asset: we recommend that, whenever possible, business owners opt for convertible term key person insurance, specifically with a mutual company. As the business and cash flow grow, business owners must continually reinvest in the business. The first stop for that capital should be converting to whole life and then using the newly formed line of credit, uniquely found through the policy’s cash value, to fuel the growth. Savvy CFOs and CPAs, including the overwhelming majority of the Fortune 500, do this for the business (the exception being banks, which buy Bank Owned Life Insurance, or BOLI).

How to Turn Key Person Insurance Into a Line of Credit

Let’s say you’ve purchased key person insurance in a convertible, vs. standard term policy. Fast forward 12 months–your business has grown. Congratulations! Now, you need capital to continue growing, whether for purchasing equipment, bridging accounts receivable, or scaling operations.

For most business owners, capital requirements are an inevitable growth cost that would traditionally be covered by a business loan. However, we find it is always preferable to fuel your growth with an asset that expands your balance sheet, not by begging a bank for credit on their terms. The banking feature of life insurance can provide a first-stop, low-cost, easy-to-access benefit to augment ongoing capital requirements. By fueling a life insurance policy, the business also builds a second asset class–the policy cash value–in addition to the death benefit! You now have access to a line of credit that pays you if something bad happens…pretty powerful.

So, how do you actually do this?

Decide to pay the business first.

Remember PEMDAS, or Please Excuse My Dear Aunt Sally? The order of operations in banking matters, too. By changing the sequence for cash flow (incorporating life insurance), business owners can grow assets that become leverageable. As your business grows, it becomes even more important to pay the business first, before paying for other necessary expenses, such as salary, payables, rent, etc. We generally find that savvy business owners leverage a more sophisticated order of operations: they transfer cash from their business deposits immediately after receipt to their key person life insurance policies, then borrow from their policies to fund everyday company expenses, particularly fixed costs like equipment and rent/real estate costs. Instead of building their business checking account and “zeroing” it out to pay these company expenses, the business owners are creating wealth through the continuous compounding effect of whole life policies attached to their key personnel.

Savvy CPAs and business owners accrue assets, not liabilities. They know that key man whole life insurance is not an expense. We often think of it more like an asset on a balance sheet; insurance grows in value over time. After conversion, the line of credit feature and the guaranteed growth build assets.

A well-structured policy will provide consistent access to capital through a continually growing embedded cash value, creating a unique opportunity for business loans. Unlike other forms of borrowing (e.g., a bank line of credit, traditional loan, or even an SBA loan), borrowing against a properly designed key person insurance policy doesn’t incur set repayment terms. As long as your policy is well-capitalized and is a corporate-owned key person insurance policy with a dividend-paying mutual insurance company, you can borrow against it with no set repayment terms. In this way, it provides a great first option for ongoing capital needs with unmatched flexibility.

A Word to the Wise: Proper Implementation of Key Person Whole Life Insurance

While this type of legacy banking is clearly advantageous for business owners, proper implementation requires a thorough understanding and carefully constructed policies. Once you have started your policy or are recommending this route to a client, you need a comprehensive understanding of the nuts and bolts.

Manage Your Loan Amounts

Managing loans is an important aspect of building your own economic system. While there are no repayment terms when borrowing from a life insurance policy, we recommend that when you are purchasing an asset through a loan, you pay only the interest portion of the loan from the insurance company. This allows you to earn compound interest while paying simple interest, which is fundamentally what banking is all about. Any principal repayments to the policy also regenerate future capital availability. Should your key person die, any loans on the policy will reduce the death benefit payout. It is important to remember the alternative here as well: you would have to pay interest to your bank/line of credit either way, so let’s build another asset while we do it.

More acutely, we advise our clients and help them structure repayment terms when buying a liability, like a company vehicle or real estate. In these situations, when you buy a liability for your business or yourself, such as a heavy vehicle or a piece of real estate, we recommend that owners repay the loan as if it were an amortizing loan. This means repaying both principal and interest at a specific rate and frequency. After all, with these policy repayments, you'll just be paying yourself back and providing future liquidity.

This is radically different from paying off a loan from a third party, like a bank. If you repay a portion of your loan to a bank, they will not allow you to access that capital again if it is an amortizing note. This powerful nuance is used by savvy business owners and consumers of debt to understand and utilize it to their great advantage.

Understand Tax Implications

When you borrow from a key person whole life insurance policy, it’s seen as debt, rather than income. In the US tax code, debt is not taxed as income. Imagine if, when you took out your mortgage to buy your house, the amount that you borrowed from the bank was not treated as taxable income! There are nuances, however, associated with key person insurance and the tax deductibility of the premiums. Additionally, life insurance premiums for company-owned key person insurance are not tax-deductible in many cases. Properly structured key person insurance can be seen as a way to retain talent, protect the business while adding a valuable, leverageable banking asset, and manage the income statement of the business.

Key Person Whole Life Policy Loans vs. Traditional Business Loans

Leveraging whole life insurance in this way dramatically changes the control and financing optionality of your business, which is why we cannot overstate the importance of this strategy. But how does it compare to traditional financing options? Let’s examine a brief comparison before exploring key differentiators.

Line of Credit Options for a Small Business Owner

As of March 17, 2025. Please note that interest rates and terms are subject to change based on market conditions and individual qualifications. It is advisable to contact each institution directly for the most current and personalized information regarding their business line of credit offerings.

Lower Interest Rates

One of the most noticeable benefits is that interest rates on loans from dividend-paying whole life insurance are typically in line with or lower than traditional financing options from banks. As of this writing and within our chart, you can see that average collateralized business loan rates from traditional sources range from

6.42% to 12.41%, though we find most business lenders are on the higher end of that range, particularly for small businesses. Comparatively, interest rates at life insurance companies generally vary between 5% and 8% a year, with one very interesting caveat: they can never exceed 8%.

The ability to source a lower cost of capital than your competitors have access to is appealing enough on its own. An additional incentive is found by examining the bigger picture: when you borrow from your life insurance policy, you are still building an asset while you borrow, due to the constantly compounding nature of the cash value and death benefit of the life insurance policy. When you borrow from a traditional bank, you are creating an asset for the bank and a liability for yourself. However, when you borrow from your whole life insurance policy, you are creating an asset for your business, and incurring that same liability on repayment terms you can set. So why not build a policy, leverage its cash value, and repay based on terms you establish?

This is how you can grow your balance sheet alongside your business.

Flexible Repayment Terms

Many people are astonished to learn that there actually aren’t any repayment terms associated with borrowing against the cash value of your life insurance policy. It is often counterintuitive for us to think about borrowing with no repayment terms because most forms of lending are not pre-collateralized. However, borrowing against your life insurance policy is simply a pre-collateralized loan from the capital you've already paid into the life insurance policy. This nuanced and specific distinction gives the business owner complete and total freedom and control in deciding when and how much to repay the loan. We cannot overstate just how incredibly important this facet of borrowing from your whole life insurance policy is.

When we borrow from a life insurance policy, we have freedom in terms of repayment to manage our cash flows and repay the loan after the project in question has begun to produce the associated benefits. This is a complete and total game changer for business owners.

Simplified Loan Approval Process

Another benefit is in the process of borrowing itself. When sourcing capital, we can choose to sign reams of paper and spend extensive time shopping and securing funding from a traditional lender, or spend the 35 to 45 seconds it takes to borrow against a life insurance policy.

Why is this so simple? The loan is already pre-collateralized, and, as such, its risk is mitigated. You've already sent the capital, and you are now deciding to borrow against it instead of depleting it.

Additional Benefits of Business Loans Through Key Person Whole Life Insurance

Tax Advantages and Continued Cash Value Growth

As

we've noted before, perhaps one of the most interesting aspects of key person whole life insurance is that it exhibits no volatility while still growing completely tax-free. Even cash in a money market fund has interest rate risk, the growth is taxable, and when you withdraw cash, it stops compounding. Conversely, when you source capital from a life insurance policy, you are in effect putting a HELOC against your cash value and allowing everything you've already put into the policy to continue growing indefinitely. No other asset guarantees uninterrupted compounding interest with 100% tax-free growth and no repayment terms.

Recapturing Interest Costs

One of our favorite things to think and talk about when it comes to dividend-paying mutual whole life insurance is the ability to recapture interest costs. When you spend money from your checking account, you are taking on debt. Consider: you are giving up what that capital could have grown to. This is, in effect, a debt to your future self in the form of opportunity cost. When you allow your cash to compound uninterrupted, tax-free, and use other people's money (in this example, the mutual insurance company's money), you allow your capital to earn interest and dividends. In either case, you are taking on a liability. The question becomes, would you rather take on a liability and keep earning the same dollar over and over again, or would you rather take on a liability in order to allow your capital to grow indefinitely? Either way, you are taking on a liability…

Creating Financial Tailwinds for Your Business

The benefits of using dividend-paying whole life insurance for key person protection are incredible and limited only by the education and creativity of the company or CPA. To reiterate, some benefits include but are not limited to:

- Protecting the business from the loss of key employees

- Reducing the opportunity cost of capital

- Growing the company's balance sheet with a valuable life insurance asset in a guaranteed and tax-free manner

- Earning a rate of return on your expenses

- Offering greater control over cash flows due to no repayment orand/or flexible repayment terms

- Sourcing capital at or lower than conventional banking terms

In summary, here’s how business owners and CPAs can simultaneously protect key employees and form a low-cost, leverageable asset through key person whole life insurance:

- Identify your key personnel.

- Work with a trusted, licensed advisor to secure convertible term insurance through a top-rated mutual carrier. This is easy, low-cost, and offers incredible flexibility.

- Catalogue your expenses, starting with your fixed costs.

- Secure a key person whole life policy through a trusted advisor based on those costs.

- As the business grows, additional whole life policies can be added via the conversion feature on the key person term policies.

About Fusion Strategies

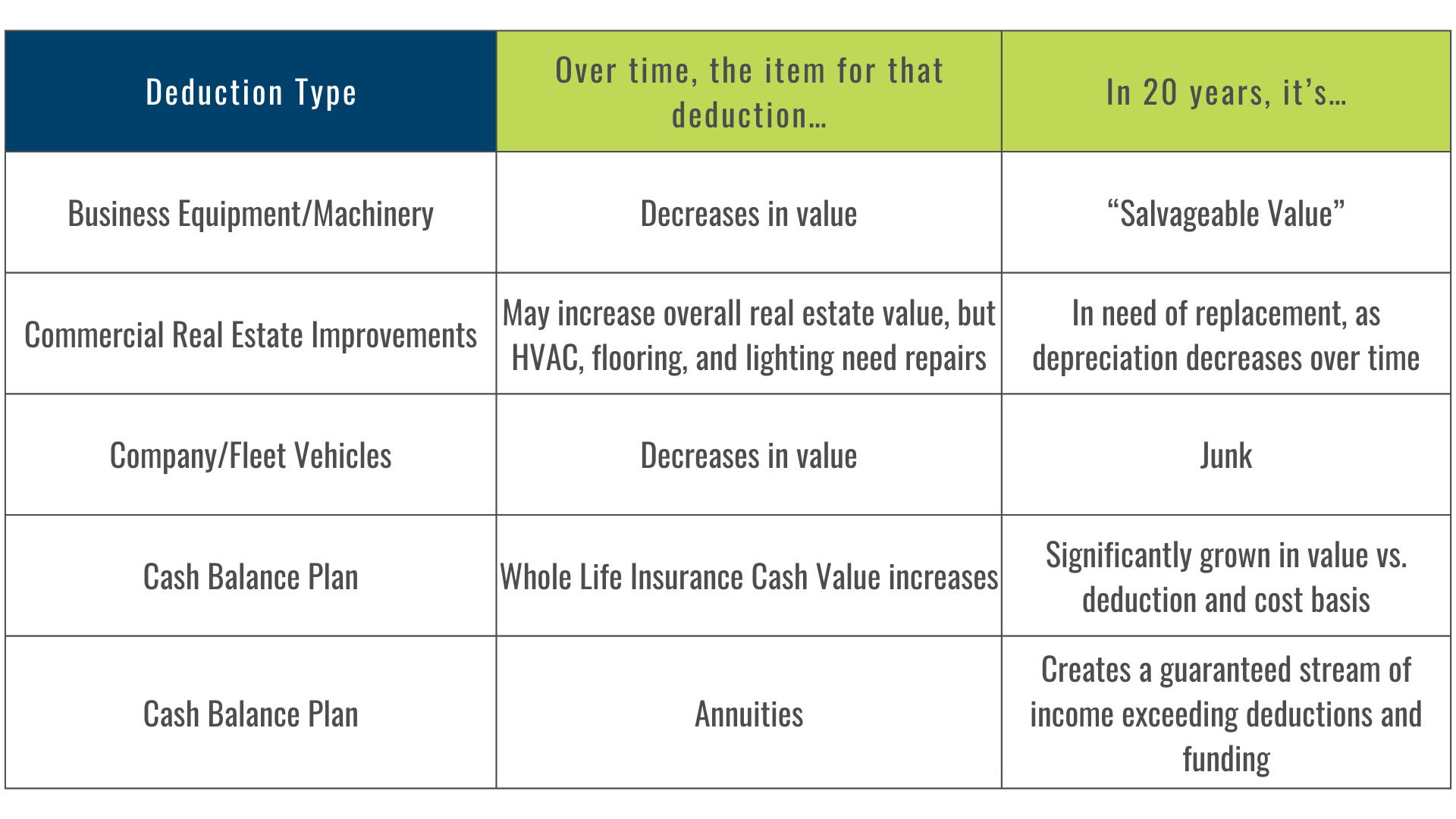

At Fusion Strategies, we specialize in helping boutique CPA firms and their small business owner clients maximize corporate tax deductions while securing significant retirement assets.

Profitable business owners often feel trapped between persistent tax burdens and an under-funded retirement. Our expertise lies in designing and implementing defined benefit plans, particularly cash balance plans, tailored for these business owners. These “Pensions for Proprietors” come with substantial deductions, often six figures, to fund a retirement that reflects their life’s work.